As predicted, TCL Electronics (1070.HK) wows with 2023 results and continues push into high-end products

Sales up in lucrative large TV segment, with supplementary income streams showing healthy growth

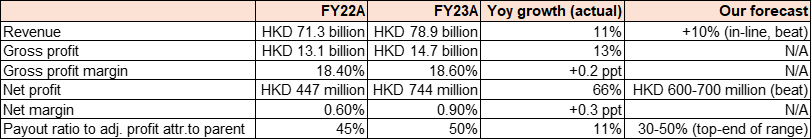

Spirits were high as we attended the TCL Electronics (1070.HK) (“TCL”) investor conference last Thursday (28 March) at the Shangri-La in Hong Kong, following its after-market earnings release. The results topped our own expectations in some areas, which we outlined in our recent write-up on the Company. We decided to summarize the results, as well as management insights shared at the conference for added context.

TCL’s shares saw a strong bounce at market open and are up 26% today. Overall, the Company saw strong revenue and net profit growth, with its payout ratio landing at the top of their dividend policy range. Our thesis on a positive set of results to drive a re-rating and bridge some of the discount is playing out.

Solid growth in mid-to-high end display sales, as well as from Photovoltaic and Internet businesses

The results highlighted strong expansion of mid-to-high end display sales, rapidly expanding supplementary businesses, and solid emerging markets growth – all trends which we discussed as growth drivers in our previous write up. Standout figures in these areas include:

Shipments of TCL’s high-end 65-inch+ TVs soared by 35%, accounting for 25% of TCL’s total shipment of smart screens.

TCL saw 17% yoy growth in emerging markets, with similar figures in North America and Europe. The Company is a top 5 brand in rapidly growing consumer markets like India, Vietnam, and Saudi Arabia. It retains pole position in China, where growth has been sluggish due to obvious macro factors.

The scale of TCL’s All-Category Marketing and Smart Connection and Smart Home businesses grew a solid 22% yoy as the Company leveraged its single-brand influence and geographically diverse retail channels built up by its display business.

The true star of the show was the Photovoltaic (solar) business. Founded only in Q222, it has grown at breakneck speed of 1820% yoy to HKD 6.3 billion (USD 805 million) and now contributes a hefty 8% of group revenues.

The lucrative Internet business grew at 20% yoy on higher gross margin profile (55% in FY23A vs 50% in FY22A) representing 4% of group revenues, and carried around 30-40% of TCL’s profits. A similar trend is expected to continue in FY24e.

Our segment-specific forecasts largely held up, with Photovoltaic significantly outperforming and All-Category Marketing (household appliances) underperforming.

Here’s how the make-up of TCL’s business is changing, reflecting the growing importance of supplementary revenue streams over the core display business:

Future strategy to focus on increased profitability, workforce and sales channels synergies, and international expansion

Management highlighted a few key points during the investor conference with regards to the TCL business this year:

Management wants to maximize operating efficiencies and improve profitability. TCL understands the need to enhance these areas especially when compared to its peers.

Profitability to be improved through R&D efforts leading to technological upgrades and therefore higher average selling prices.

Introducing flatter leadership to increase decision making efficiency, also aimed at improving profitability.

Greater integration between sales channels for household appliances and displays to cut on global marketing expenses, thereby improving margins.

Building better synergies between global teams, for example, through secondment programs between geographies.

The Photovoltaic business will be further prioritized for investment, with management targeting to double revenues to HKD 12 billion (USD 1.5 billion) in FY24e. For now, this vertical is focused on the domestic market, but that could change.

TCL will also look to upsell customers in developed markets, where the Company already has a strong presence. Emerging markets are more of a volume play for now, but still targeting a mid-to-high end strategy, as TCL aggressively expands its market share.

Our take on the numbers going forward

For FY24e, we expect revenues from TCL’s overall display business to return to growth, carried by its large-sized display business with continued strong performances in emerging markets. TCL’s small-and-medium sized display business should see continued drag owing to the scale-down of its smart mobile business (2/3 of the vertical). The segment should see a contraction in-line with overall industry declines of around -20-25%.

Supplementary revenue streams from the Innovative business are expected to generate around 40-45% yoy growth as a whole, with All-Category Marketing and Photovoltaic to carry bulk of the revenue uplift. Management is also expecting around a double digit growth for its Internet business. We will be keeping a eye on H124e results on how this all tracks

Prior to the release of TCL’s FY23A annual results, the Board issued 82.3 million shares to a 363 persons affiliated with the company. This award will be satisfied in form of existing Shares subject to the achievement of the performance targets set out for the coming three years.

Based on the share award scheme, TCL management will be targeting net profit (adjusted profit attributable to owners of the parent) of around HKD 1.32 billion (USD 169 million) [65% higher then the net profit of FY22A] and have plenty of incentive to do so. It remains to be seen whether this might be a stretch target, but we can certainly see a pathway for TCL’s net profit to return above HKD 1 billion (USD 128 million) this year, which would suggest a forward P/E range of between 6.7x-8.9x based on the current share price (HKD 3.57 as at 2 April 2024).

Another potential tailwind for the share price is coverage – the lack of which we pointed out in our last piece. We note that several Chinese brokers who had previously covered the stock, as well as some of the bigger western banks, attended the conference – a signpost for better coverage.

For an in-depth brief on TCL, readers can refer back to our post on the Company last month.

Full disclosure: Both me @TheAltraman and @Desertfox currently own the stock.

Disclaimer: This research piece above is for informational, entertainment, educational, and/or study or research purposes only. The information contained herein or discussed does not, should not, and cannot be construed as or relied upon and, for all intents and purposes, does not constitute or provide professional financial, investment, or any other form of advice. This research does not and should not be construed as an offer to sell or the solicitation of an offer to buy any securities or any other financial instruments in any jurisdiction, including where such actions are illegal. This research is not intended for publication in jurisdictions where it would violate laws. The research does not consider individual investment objectives or financial positions and merely expresses the opinions of its authors. Any investment involves taking substantial risks, including (but not limited to) the complete loss of capital. Every investor has different strategies, risk tolerances, and time frames. You are advised to perform your own independent checks, research, or study, and you should consult a licensed professional before making any investment decisions. The assumptions and parameters discussed or used are not the only reasonable ones, and no guarantee is given for their accuracy, completeness, or reasonableness. No promise is made that any indicative performance return will be achieved. The research is derived from public information sourced by Pyramids and Pagodas. No representation or warranty is given for the reliability, completeness, timeliness, accuracy, or fitness of this research, nor is any responsibility or liability accepted for any loss or damage. The authors (Pyramids and Pagodas) shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Did you guys predicted exactly that? I thought it's a long-term appraisal