Asian defense and industrial winners in the Trump Era?

How shifting US policies could prove to be a boon for certain companies in Japan, South Korea, and Hong Kong

As the Trump presidency unfolds, investors are understandably anxious about the impact of his policies on Asian companies. However, instead of focusing on the negatives, we aim to spotlight some of the companies that are uniquely positioned to benefit from the shifting geopolitical landscape. Amidst the uncertainty, these firms are leveraging strategic advantages and emerging as potential winners in the Trump era, and yet many trade at fairly reasonable valuations factoring the aforementioned market jitters.

One unintended consequence of Trump’s unpredictable and heavy-handed negotiating tactics is that customers of US defense manufacturers (both in countries with friendly and not-so-friendly US ties) are increasingly looking elsewhere to mitigate the risk of being cut off from US technology. This also comes at a time when geopolitical tensions in Asia are ramping up, with Korean and Japanese defense manufacturers enjoying robust demand domestically and from neighboring countries.

Additionally, investors fearful of tariff risks may be unfairly penalizing Hong Kong or Chinese companies with robust US manufacturing and supply chains tariff risks, despite their relative insulation from such impacts. Some companies are more agile than others when it comes to navigating the evolving trade environment – and those that invested early in manufacturing outside of China are likely to benefit.

Although we have not performed comprehensive screening and analysis of the companies we are about to mention, we consider them interesting due to their alignment with policy or established presence in North America.

We picked up a few interesting names that caught our eye across three emerging and mature markets in Asia, namely Japan, South Korea, and Hong Kong/China. This article explores how these international players are navigating the evolving landscape and positioning themselves for growth.

Korea

Hanwha Aerospace (012450.KS; “Hanwha”), a South Korean defense and aerospace company with a market cap of USD 19.45 billion, is streamlining operations to focus on defense technologies across land, sea, air, and space. With South Korea aiming to rise from ninth to fourth in global defense exports by 2027, Hanwha is positioned to meet growing demand amid geopolitical tensions.

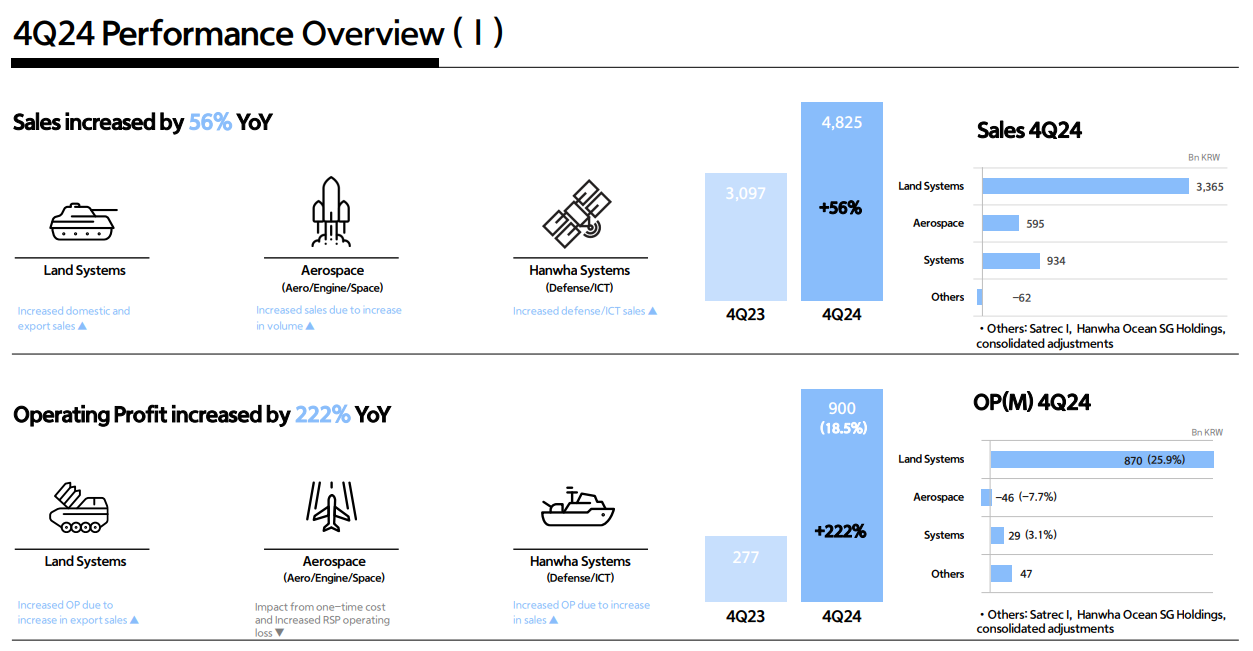

With a stellar run-up prior to their most recent Q424 results, the stock surged another 18% after reporting on February 18, with revenue up 56% YoY to USD 3.29 billion and operating profit soaring 222% to USD 608 million. This growth exceeded market expectations, driven by strong domestic and export volumes, especially in the ground defense sector. Ground defense sales rose 75%, with exports making up 55% of total sales, reflecting strong international demand. The order backlog, largely for export, supports this trend. Despite ongoing losses in the aerospace segment, management expects 20% YoY growth in ground defense for FY25e, boosted by domestic production and exports to Poland and Romania. The aerospace sector is expected to improve with increased military volumes.

Despite the recent stock run-up, Hanwha gave back some of its gains following a well-timed share issue shortly after the rally to raise USD 2.7 billion to bolster overseas and domestic production to meet international demand. While Hanwha’s top executives have vowed to purchase USD 4.4 billion of stock as part of the raise, this planned issuance hasn’t been well received by the market, reflecting a recurring theme prevalent in Korea: the “Korea discount.” This phenomenon occurs when South Korean companies, particularly those under the chaebol (large family-owned conglomerates), trade at lower valuations compared to their global peers due to a lack of accountability and governance practices regarding capital allocation and shareholder rights aimed at maximizing shareholder value.

The South Korea Financial Supervisory Service (FSS) has put a halt on approving the rights offering for now to gain further clarity as the Company itself has plenty of ammunition and cashflow to fund their own expansion. It’s noteworthy that Hanwha recently acquired an additional 7.3% of Hanwha Ocean from Hanwha Energy and Hanwha Impact for USD 886 million on March 13, increasing its stake to 30%. This raises questions about the timing of the acquisition. Hanwha Energy is entirely owned by the three sons of Hanwha Group, while Hanwha Impact is 52% owned by Hanwha Energy. Some view this as a strategic move towards streamlining operations in defense, while others speculate it may serve to secure funding for the heirs.

It is a case of “wait and see”. If the issues mentioned above blow over and shaky corporate governance can be accepted, focus will shift back to Hanwha’s operational performance and pipeline in the coming years, which could help bridge some of its discount gap should good results be achieved. The stock remains reasonably priced compared to its US counterparts, with a blended 12-month forward P/E of 17x and an EV/EBITDA of 12x, effectively trading at discounts of 41% and 33% to international names. President Trump’s call for NATO members to increase defense spending to 5% of GDP from 2%, combined with NATO countries already de-leveraging from US policy volatility, enhances Hanwha’s European prospects.

Hong Kong / China

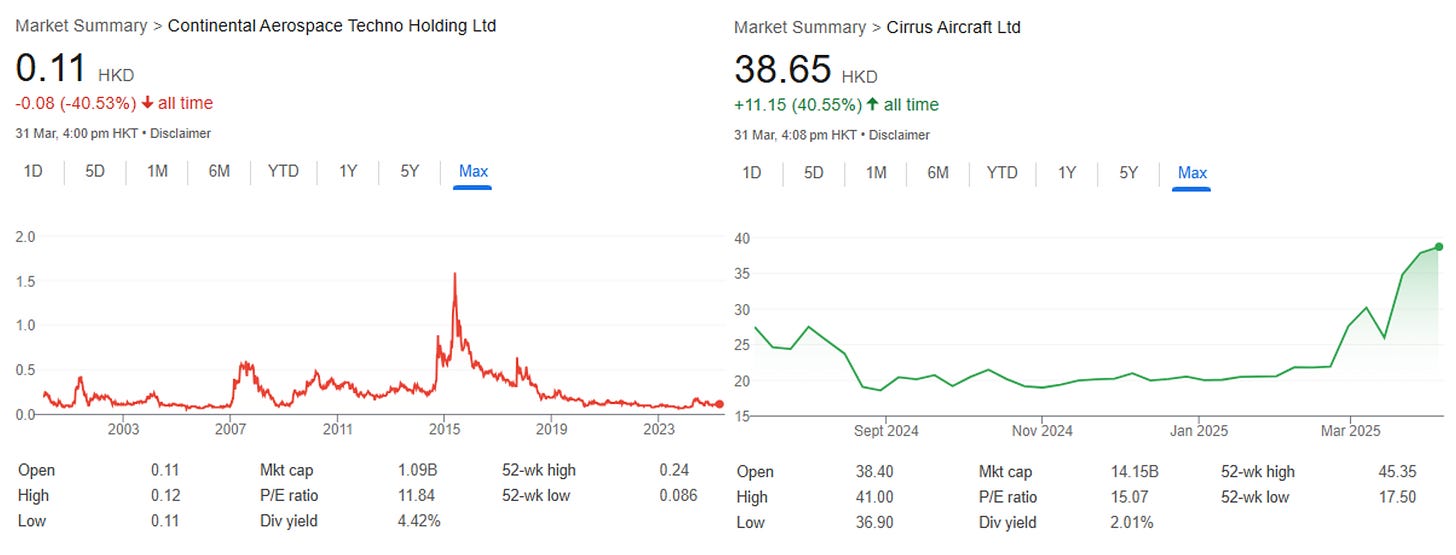

Notably, we identified two companies from Hong Kong/China: Continental Aerospace Technologies Holding Limited (0232.HK; “Continental Aerospace”) and Cirrus Aircraft (2507.HK; “Cirrus”) with market caps of USD 136 million and USD 1.78 billion respectively. Both firms are engaged in the manufacturing and sale of aviation components and aftermarket operational services for both retail and institutional clients. There is some overlap between these companies, as they both operate within the civilian sector; intriguingly, the parent company of each is owned by the sanctioned Aviation Industry Corporation of China (AVIC), holding 46% of Continental Aerospace and 85% of Cirrus.

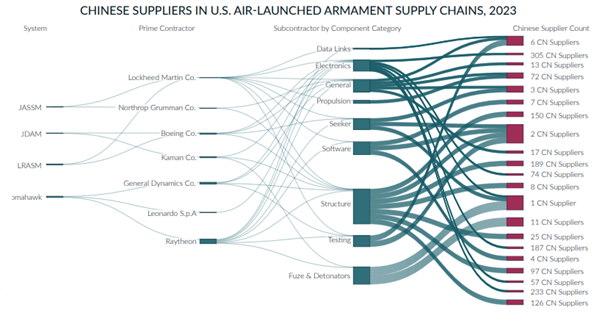

Trump’s “America First” policy, which emphasizes strengthening military capabilities and supporting capital-intensive domestic industries, is somewhat ironic. In 2023, Raytheon’s CEO said that while the company can "de-risk," they cannot fully "de-couple from China." Raytheon itself relies on thousands of suppliers based in China, and with over 95% of rare earth materials sourced or processed there, particularly for critical supply chain components, the US would face significant repercussions if it withdrew in a manner similar to its actions concerning Russia. This highlights the intricate nature of the military-industrial complex. What about the civilian side?

Interestingly, Continental Aerospace generates approximately 78% of its total revenues (over USD 180 million) from the US market, while Cirrus, the largest private jet manufacturer globally, derives all of its revenues (over USD 1.2 billion) from the US. Both companies boast well-established supply chains in the US, which helps them circumvent potential issues related to tariffs. They also maintain strong capital positions, with net cash balances of 48% and 24% relative to their market caps.

Both Continental Aerospace and Cirrus are trading at over 40% discounts compared to their international counterparts, with their 12-month blended forward P/E and EV/EBITDA holding at around 15x and 3x respectively at current levels. They exhibit similar margin profiles, featuring low to mid-30% gross margins, mid-low teens EBITDA margins, and mid-high single-digit net margins, alongside anticipated earnings growth in the high-single digit to low teens. Even with applying a corporate discount on these entities, there is potentially some value uplift so long as they show continued growth – one would just have to be comfortable with their parent, AVIC.