Gas Malaysia Berhad (GASM.KL) – The pipeline titan powering Malaysia’s industry

A quiet utility patiently positions itself for market liberalization, an opportunity the market has yet to recognize

Gas Malaysia Berhad (GASM.KL; “GASMIA”) with a market cap of USD 1.5 billion is a leading pipeline operator and distributor of natural gas to primarily industrial customers in Peninsular Malaysia. Their numbers looked compelling on paper, so we wanted to get the full picture from management on a recent trip to KL, which proved insightful as there’s more to the story than meets the eye.

The Company is fairly well covered by the local sell-side, but we see a wider story that is potentially missed as quarterly earnings don’t capture what happens when the rules of an entire energy sector will be re-written over the coming decade. The consensus view is simple: GASMIA trades a ~6% yield with limited growth at near fair value. Yet, we think this framing misses a fundamental shift that is underway. Between now and 2030 beyond, Malaysia’s gas market is slated to fully liberalize with subsidies to unwind and new infrastructure reshaping competitive dynamics.

Understanding the business

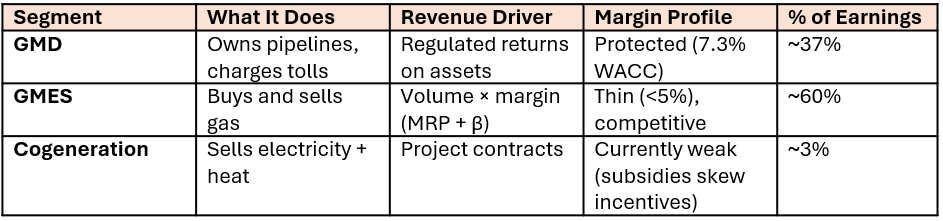

GASMIA operates as a blend of a regulated utility and a competitive trading business and can be broken down into three business units.

1. Gas Malaysia Distribution (GMD) – “The toll road”

Think of GMD as operating pipelines which function as a toll road for gas. The Company owns over 3,000 km of medium-to-low pressure pipelines across Peninsular Malaysia. The vast majority of the gas that flows to industrial customers, whether sold by GASMIA or competitors using their pipelines, pays a toll.

The Energy Commission (Suruhanjaya Tenaga, or “ST”) sets GMD’s toll revenue using a formula that guarantees a return on assets:

Allowed Revenue = (Regulated Asset Base × 7.3% WACC) + Operating Expenses + Depreciation + Taxes + Unaccounted Gas

This is classic utility regulation. GMD invests in pipelines, the regulator allows a 7.3% return on those assets, and customers pay tariffs that cover costs plus profit. The more pipelines GMD builds, the higher its allowed revenue.