Interview with Alex Chan, Founder and Chairman of Plover Bay Technologies (1523.HK)

An Asian home-grown success story sits down to tell us how he scaled from humble beginnings to a global business serving the needs of our increasingly connected world

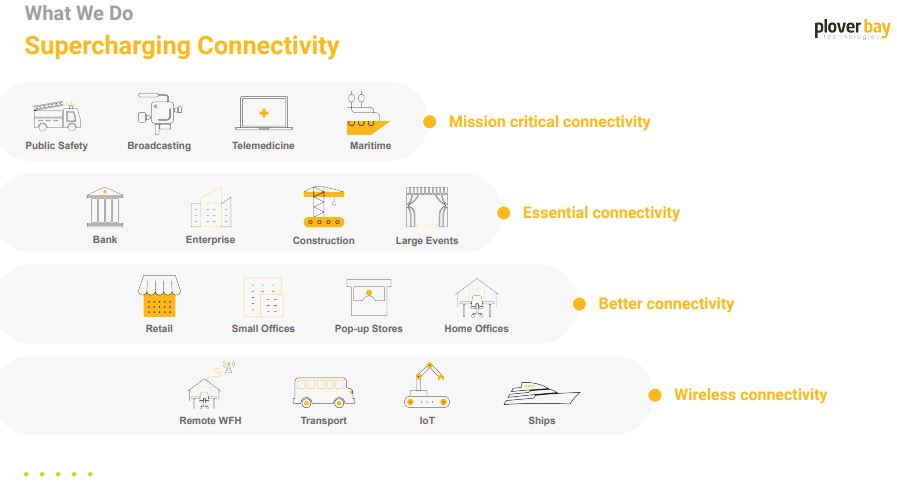

Plover Bay Technologies (1523.HK) (“Plover Bay”), listed on the HK Stock Exchange in 2016, is an under-followed niche company that sells routers and software licenses. Have you ever wondered how Wi-Fi connectivity works on planes, trains, and automobiles? Plover Bay’s routers remove the need for wired connections by drawing on 4/5G networks and low-earth orbit satellites (like Starlink) to provide connectivity in hard-to-reach areas and to users for whom connectivity could be a matter of life and death.

The stock trades at net cash (8% market cap) with a forward blended P/E of 10x, EV/EBITDA 7x, EV/Sales of 2.5x. Plover Bay is a strong dividend play backed by solid operating cash flow. We expect management to maintain 80-90% payout, reflecting an 8-9% yield.

With the company starting to turn heads in the investment space (see Michael Fritzell’s October 2023 coverage on Plover Bay at Asian Century Stocks), we wanted to highlight an additional perspective – in the Founder’s own words. We were fortunate to meet Alex Chan 1-on-1 and wanted to share his insights on leadership, vision and how these attributes continue driving Plover Bay’s strong operational execution and future trajectory.

Mr. Chan has reviewed and approved the text of this article to ensure alignment with his views.

Can you tell us a bit about your background, how you came to start Plover Bay and the entrepreneurial challenges you faced along the way?

I was born and raised in Hong Kong back in the late 60s. I was lucky enough to discover my passion in electronics during my teenage years. Those were the days when digital electronics and the PC industry started to emerge. In those days, my hobby was to build computers and enhance them with various new parts. Later, I started to connect to bulletin board systems (BBS), much like today’s discussion forums, with dial-up modems. This allowed me to connect with a group of computer enthusiasts for learning and sharing.

After my graduation from the Hong Kong Polytechnic, predecessor of today’s Hong Kong Polytechnic University, I joined Dow Jones Telerate, a US company, as a network engineer. The company operated a proprietary global data network to provide real-time financial information to bulge bracket investment banks and brokers back in those days, which as you can imagine, is very mission critical. Being a network engineer gave me the opportunity to learn data communications and networking in a mission critical environment.

After working there for a couple of years, I started a network system integration business. The business brought cutting-edge networking technology products from the US to Asia. We brought back products including Ascend Communications, Alteon Networks, etc., the pioneers of the Internet era and helped our customers build the very first internet service providers in Asia. During the mid to late 90s, commercial internet started to boom in Asia and our business was pretty successful, up until the internet bubble burst. The experience of running a network system integrator gave me valuable insights into product development. However, I had no experience in managing a company during an industry downturn.

While we enjoyed fast growth in the mid 90s to 2000, there have been many painful lessons during the spiral downturn from 2001 to 2005. I learned that wishful thinking is not a solution to recover the business back to its glory days. When business environments change and evolve, those at the helm must quickly come up with new perspectives, understand the dynamics and make the essential changes before it becomes too late.

The business was started in 2006 with the proliferation of Wi-Fi, mobile broadband, and contract manufacturing. At that time, SD-WAN and wireless networking looked very promising. This has been an exciting journey as technology keeps evolving and new opportunities keep arising.

As the leader of your business, what would you identify as your leadership style and management approach? How do you motivate and inspire your team? How do you foster a culture of innovation within Plover Bay?

When you bring in people who really love what they do, you don’t need to motivate them very much. They are self-motivated and they’ll keep finding new ways to improve things.

We also encourage team members to take ownership. We currently employ around 200 staff, of which 70% are programmers, engineers or technicians. I typically break staff into smaller teams of 8-10, giving them speed, passion, and conviction and avoiding bureaucracy. Decision making is pushed down to frontline teams that understand their products, services, and clients best. Each of our engineers have full ownership of a few products from the very beginning to the after-sales process. They do a great job developing the initial features, adding new features over time, and polishing the platform over time, and they are proud of the product that they created. They then take the lessons learned and bring it over to a new product.

Of course there is also the monetary aspect. One of the biggest reasons we went public was to provide a way for staff to visualize the hard work they put in over the years. Even now, every new recruit gets a decent amount of share options after their first annual review. Seeing the results of your work translate into the company’s share price is a strong motivator. The share price is more like an indicator to “visualize” how we are playing in our favorite game.

When most team members are focusing on their best game, the personal ego is less important and naturally everyone becomes a team player.

I encourage a passion-led culture and solutions-oriented thinking. While results are important, I believe building the right culture takes precedence over short-term targets. This means we can nurture top talent that shares the company's long-term vision. This is front-and-center in our hiring – we give opportunities to those from diverse and unconventional backgrounds and those that might have been overlooked by other companies due to stumbling blocks they may have faced in their careers.

At Plover Bay, we see mistakes as learning opportunities and a necessity for progress. Conviction and execution are key irrespective of whether a project succeeds or not. I would rather we progress towards a goal than dither over different courses of action. I give staff a lot of autonomy but won’t hesitate to intervene if this autonomy is not used to drive progress.

In what ways do you continue to challenge yourself and the organization?

When you enjoy the game so much, you want to do it better everyday. You are willing to try new approaches and run new experiments. This is where most of our innovations come from. We make mistakes, and this happens pretty often. But one great thing here is that we accept failures and we learn fast.

This is not only coming from myself, many of our key team members feel the same way. We just enjoy building something. This something could be the product, the service, the supply chain, the internal system, and the functionalities that could make our customers, partners more happy. People here build something from nothing, and that is highly rewarding.

This may come to a surprise to many people - it’s actually not easy to find a workplace that offers stability while providing an ambitious environment to let you do things better and better. There is also a great side effect which is monetary return.

In its annual reports, Plover Bay has often mentioned that it will continue to improve its operational efficiencies. Can you give us an example?

A few years ago, we greatly expanded our backend system team and also added a digital innovation team. One example of what the team did was automating the order and shipping processes. Here, the backend team consolidated the information from our own backend, the courier’s portal and our accounting system, and using this, they developed a customized shipping portal. Before this, our shipping team had to input the same information (eg. shipment address) in three separate systems. The new system frees up a few hours for each shipping team staff member every day. It also reduced the chances of errors which would require more time to fix.

We constantly look for changes and improvements in our products, processes. We always ask ourselves, is there a more efficient way to do it? This is the foundation behind our continuous product and operational improvements. A lot of times, this is where our innovations come from.

What are your long-term strategic priorities and growth vision for Plover Bay over the next 3-5 years?

Plover Bay has historically been growing at around 20% a year. We have done many things to make this happen. In the past, we said that going from 4G to 5G would drive down the cost of mobile data and encourage the adoption of mobile networks among enterprise networks. In 2023, 5G routers will likely exceed 20% of all the routers we shipped.

Earlier this year, we became Starlink’s Authorized Technology Provider, an official recognition that Peplink’s products will work with Starlink equipment. This allows us to tap into Starlink’s growing user base of enterprise customers, especially in the maritime, emergency services and mining industries. Our products complement Starlink well. Users can use our devices to bond Starlink with other networks, or even multiple Starlinks, which vastly improves reliability and performance. Users can also manage a large number of Starlink dishes through our management software, and we have a large network of approved Starlink resellers offering full support to those enterprise users.

We also said that we wished to grow recurring revenues to over 30-35% of our revenue. Recurring revenues have a software margin profile and are a lot more scalable than hardware. We have been growing recurring revenues in a few ways.

First, we have been growing the pool of potential subscribers. Peplink routers can be thought of as gateways to our ecosystem. Once a user purchases a Peplink router, there is a decent chance of the purchaser becoming a subscriber, with potential for future repeat purchases, or even the chance to scale to a much bigger deployment. So, it makes sense for us to forgo a small amount of upfront margin in order to accelerate the future growth pipeline.

Second, we are also increasing the value propositions of our subscriptions - both by giving a better deal or adding plenty of extra features, such as SpeedFusion Cloud, which was a metered service in the beginning but has been turned into an unlimited service. We also added major features such as InTouch (allows users to manage non-Peplink devices connected behind a Peplink router), better integration with Starlink, Peplink eSIM, and more.

These two factors have been driving our recurring revenue growth. Our subscription “take up rate” - which measures the share of devices currently paid for with a subscription, has been inching closer to 30% each month, from around 25% about two years ago. The number of registered devices in our system (i.e. the potential subscription pool) has almost doubled since the beginning 2021.

Then we are also creating new services, such as the Peplink eSIM data plans (previously SFC LTE service) which was launched in 2021. The service now accounts for over 2% of our total revenue in 1H23, and is highly recurring with a strong margin profile.

To sum up, we are confident that all these developments will help us maintain our mid-to-high teens growth annually on our business model and continue to expand our recurring revenue base.

How will evolving technologies shape the company’s growth vision and influence its product offering going forward?

Going forward, connectivity technologies will keep evolving. We are still in the early years of moving from 4G to 5G, and people are already starting to talk about 6G. There are also new players like Starlink, who bring us affordable satellite service. Then we will also have OneWeb. There will be more and more connectivity options… more and more network providers.

Low earth orbit (LEO) services such as Starlink are a game changer. It dramatically expands where you can connect. More and more areas will be covered by low earth orbit satellites. In the LEO satellite space, we continue to make noise. In late 2022, one of the world’s largest cruise ship companies deployed our solution to bond multiple Starlinks together for their whole fleet. Fast forward to January 2024, we are pleased to announce that we have become Starlink’s first Authorized Technology Provider, boosting our visibility and profile. We expect the agreement to bring us many more exciting opportunities in remote places that require reliable connectivity.

We’ll continue to take innovative approaches to make our solutions affordable and accessible to everyone, making Peplink a low initial investment plus an affordable on-going annual subscription package for everyone and all industries.

What are your perspectives on capital allocation, balance sheet management, and R&D investment? How do you evaluate M&A and other expansion opportunities?

Plover Bay is a true owner / founding team managed listed company. For one, many employees are actually shareholders of the company, and they are obviously in it for the long term for the reasons I mentioned earlier. This real tangible ownership in the business drives their mentality to be more like an owner than an employee. Furthermore, our shareholders are an integral part of our growth journey, and are rewarded for their long-term commitment - Plover Bay has consistently maintained over 90% dividend payout ratio over the past six years.

There are many successful large corporations. If we look into these companies as an adult, Plover Bay is still a teenager. The way that a teenager grows and focuses would be very different from a mature adult.

For instance, large companies’ executives are typically appointed by the board, with the majority of their pay structure coming from bonus payout based on certain objectives. Incentive structure may be primarily linked to the financial growth of the company during the year, or even the next quarter, while considerations for long-term substantial growth matter less.

This overemphasis on near term performance may lead to over leveraging, negative cash flow, pile up of receivables, over-hiring with layers of management that hugely affect the efficiency of the company. Over time, this becomes a culture problem deeply entrenched in the company. Being a founder-led company sets us apart from large corporations and family businesses, we constantly strive for excellence and seek out fresh talent bringing new perspectives.

With this mindset, we are open to investing in complementary markets, technology, and even applying our mindset and execution to refresh businesses that can create new value with a different approach.

Our mindset around M&A is evolution from organic growth to view connectivity-as-a-service holistically. As opposed to acquiring distributors or other networking firms of similar sizes, I prefer seeking out partnerships or acquisitions demanding reliable connectivity to continue building and strengthening our customer base.

Even small opportunities can be interesting to us, due to our experience integrating remote teams globally. Financial risk is low as deals would be pursued for synergistic value creation rather than because there is private equity backing forcing the Company to do it. When evaluating M&A, I prioritize cultural compatibility and strategic fit on top of financial metrics. Deals enhancing Plover Bay's solution scope in new industries or markets are most appealing.

Shareholder value ultimately remains the priority. In the same light, the Board and I will always entertain attractive overtures that fully recognize Plover Bay's intrinsic worth – these are assessed objectively on how they serve shareholder interests. However, the priority remains scaling operations through continual reinvestment in technology and staff. Simply accepting premium bids that undervalue long-term potential or disrupt our strategic roadmap would not be sufficient.

How will succession planning preserve the founder-led, ownership mentality that has driven success while cultivating the next generation of visionary leaders?

To ensure business continuity in case of unforeseen events, we have developed an internal succession plan, taking into consideration the fact that many team members are shareholders of our company. We continue to embrace a very entrepreneurial mindset, willing to take risks on new products, new markets and new approaches. As a company attractive to those with a “builder” mentality, we attract talent that looks beyond monetary return. When our teams excel at something, this reflects in our values and success. Naturally, this founder-led, ownership mentality will sustain itself over time.

Full disclosure: We hold shares in Plover Bay Technologies (1523.HK).

Disclaimer: This research piece above is for informational, entertainment, educational, and/or study or research purposes only. The information contained herein or discussed does not, should not, and cannot be construed as or relied upon and, for all intents and purposes, does not constitute or provide professional financial, investment, or any other form of advice. This research does not and should not be construed as an offer to sell or the solicitation of an offer to buy any securities or any other financial instruments in any jurisdiction, including where such actions are illegal. This research is not intended for publication in jurisdictions where it would violate laws. The research does not consider individual investment objectives or financial positions and merely expresses the opinions of its authors. Any investment involves taking substantial risks, including (but not limited to) the complete loss of capital. Every investor has different strategies, risk tolerances, and time frames. You are advised to perform your own independent checks, research, or study, and you should consult a licensed professional before making any investment decisions. The assumptions and parameters discussed or used are not the only reasonable ones, and no guarantee is given for their accuracy, completeness, or reasonableness. No promise is made that any indicative performance return will be achieved. The research is derived from public information sourced by Pyramids and Pagodas. No representation or warranty is given for the reliability, completeness, timeliness, accuracy, or fitness of this research, nor is any responsibility or liability accepted for any loss or damage. The authors (Pyramids and Pagodas) shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.