Overview and takeaways on Chinese commercial activity in the Middle East and beyond #6

1 Jun - 30 Jun 2022

CONTENTS

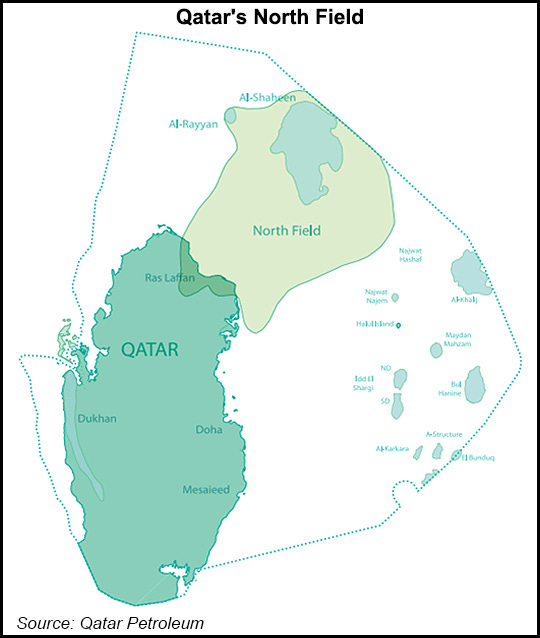

1) Talks Between Chinese O&G Majors and Qatar for Stake in Massive Field in “Advanced” Stage

2) India's Top Cement Maker Paying for Russian Coal in Chinese Yuan

3) New Railway Track Connects China's Ningxia with Middle East

4) Huawei Opens Tech Experience Center in Saudi Amid Wider Politically-Endorsed Regional Push

1) Talks Between Chinese O&G Majors and Qatar for Stake in Massive Field in “Advanced” Stage

On 12 June 2022, Bloomberg quoted insiders in reporting that China National Petroleum Corp. and Sinopec (0338.HK) are expected to invest in Qatar’s North Field East project. Reuters described the talks as “advanced,” and noted that the agreement would be the first such agreement between the two countries. The two energy majors were not available for comment. The rumored deal comes of the back of Qatar Energy officials visiting Singapore for talks with Chinese companies, according to further anonymous sources quoted by Bloomberg. Our research did not identify any further updates on the talks.

China is the world’s largest LNG importer and Qatar is the third largest exporter after Russia and the US, and its hardly surprising that Beijing is making aggressive acquisitions in this space, given intensive energy investments across the region, particularly in Iraq and Saudi Arabia as we have reported in previous articles. Another key trend we have reported on is the large-scale displacement of the US by China as a hydrocarbon export client (as US imports have dropped significantly) and the changing investment climate for Chinese firms in significant regional export markets.

Obviously, Qatar is already a massive LNG producer but investments such as the North Field East project are expected to bring the country’s production capacity from 77 million tons p/a to 110 million tons p/a by 2025. France’s Total Energies SE (TTE.N) was also awarded a 25% stake of the project in early June, with coverage mentioning that more international partners were expected to present bids to invest in the massive project.

Global gas prices are surging, and Qatar Energy is rushing to cash in on this trend, as European importers look to wean themselves off Russian gas. A chunk of Russia’s gas flows are heading to China, but pipeline infrastructure is yet to catch up with Chinese demand. China has never been particularly political in terms of where it sources energy and clearly doesn’t want to rely solely on Russia, which is basically a pariah state at this point. Sinopec and CNPC are already big buyers of Qatari LNG, but new investments in extraction are an interesting development in bilateral relations.

References:

https://www.nsenergybusiness.com/projects/north-field-east-lng-project/

https://www.naturalgasintel.com/totalenergies-awarded-stake-in-qatars-north-field-east-lng-project/

https://www.naturalgasintel.com/totalenergies-awarded-stake-in-qatars-north-field-east-lng-project/

2) India's Top Cement Maker Paying for Russian Coal in Chinese Yuan

On June 29 2022, Reuters reported India's biggest cement producer, UltraTech Cement (ULTC.NS), is importing a cargo of Russian coal worth approximately USD 25.81 million and paid for using Yuan. While the deal value is not significant, the payment mechanism for trade reinforces two perspectives that we have discussed in both January and March 2022 prior and at the outset of the Russia-Ukraine conflict:

1) multi-currency energy pricing to gain further traction; and

2) reduction in dollar hegemony

Bilateral trade between China and India, for many companies, have largely been settled in USD. However, western sanctions on Russia have led to a relative increase of use of Yuan for payment settlements. While a Rupee-Rouble or Rupee-Yuan trade mechanism has yet to be formally realized, businesses should have increased incentive to switch over, should a Rupee-Yuan-Rouble apparatus turn out to be favorable.

Looking at India’s behavior post Russia-Ukraine conflict, the country’s crude oil imports from Russia jumped 50x since April and now accounts for 10% of all Indian oil imports. This would suggest increasing merit and momentum for China, Russia, and India to build a currency swap setup that can bypass the existing dollar system despite their differences. This setup could effectively support the largest energy and commodity exporter (Russia) and the two most populous countries (China and India [35% of global population]), which also happen to be among the largest energy importers and production houses globally. The world economy is experiencing a tectonic shift, whereby the economic power of USDs is being shifted to commodity producers, who effectively have the bargaining power. China and India stand to gain the most by siding with Russia out of realpolitik, given both their energy needs at home and critical position within western supply chains.

References:

3) New Railway and Sea Link Connects China's Ningxia with Middle East

On 20 June 2022, state-owned CGTN reported that China's Ningxia Hui autonomous region launched the first sea-rail intermodal freight train carrying 51 containers of about USD 3.06 million worth of goods to Iran. The new freight railway line spans about 8,500km, departing from Yinchuan, the capital of Ningxia and passing through Kazakhstan and the Caspian Sea to Bandar-e Azanli, northern Iran. The logistics channel is also expected to lower freight costs by USD 897 per container relative to the existing railway line to Tehran and lower end-to-end transportation time to 20 days from 45 days.

While both state media, particularly on the Iranian side, have been quick to drum up the potential boost in Sino-Iranian trade as part of the Belt and Road Initiative, we would note from economic data that China’ political relationship with Iran is largely rooted in political and military ties, and while economic links are important for Iran, they are dwarfed by China’s trade ties with Tehran’s Gulf rivals.

The Sino-Iranian Comprehensive Strategic Partnership penned in 2016 includes a target of reaching USD 600 billion worth of bilateral trade within a decade, but that goal appears to be quite far-fetched. As we noted back in April,

Sino-Iranian trade in 2020 stood at a mere USD 14.36 billion, while China’s trade with Saudi Arabia and the UAE amounted to USD 65.2 billion and USD 60.2 billion, respectively

In fact, China’s relations with Iran’s Gulf rivals are far more economically important than with Tehran given that Beijing can obtain its energy needs from its Gulf partners. Beijing unlikely to risk its strategic relationships in the region for Iran’s sake should any regional or international concerns (vis-à-vis Washington or Israel) arise. However, from an apolitical perspective, the new rail-sea link is a media win and may assist exports to Iran, albeit on a small scale.

References:

https://www.chinanews.com.cn/cj/shipin/cns-d/2022/06-20/news929707.shtml

4) Huawei Opens Tech Experience Center in Saudi Amid Wider Politically-Endorsed Regional Push

On 24 June 2022, Saudi and Chinese media outlets trumpeted the opening of Huawei’s largest technology experience center outside of China. The venue, Future Space, will focus on technologies such as autonomous driving, 3D printing, and brainwave robot control. Earlier this year in February, Huawei opened its largest overseas flagship store in Riyadh, which was attended by several Saudi government bigwigs and Huawei executives. The photo opp was of course a good opportunity for the Saudis to tout the country’s digitization drive, as part of the much-touted Vision 2030 led by Crown Prince Mohammed Bin Salman. Huawei executives also stressed synergies between the company’s strategy and the government’s tech drive.

The company also announced plans to launch a cloud region in Saudi Arabia in cooperation with state-owned Saudi Telecom Company, perhaps in acknowledgment of Alibaba’s (BABA.N) own USD 500 million cloud investments in the Kingdom. This announcement was followed by an agreement between Huawei and Kuwait’s Zain Group to develop cloud, 5G, and digital services infrastructure in Saudi Arabia. These developments come as part of a healthy regional pipeline enjoyed by the company across the region, including tie-ins with Algeria’s state-owned hydrocarbon firm Sonatrach, as well as manufacturing and R&D investments in Egypt. Huawei’s regional investments are almost always accompanied by lofty statements about achieving tech-enabled national development goals and deepening bilateral ties.

Long story short, Huawei’s projects in the Middle East appear to have significant state backing, both rhetorically and in terms of the involvement of state-owned companies – optics are everything in this part of the world. Huawei, despite its claims of independence from the Chinese government, enjoys significant state subsidies in the form of grants and cheap financing. Much of its expansion in the Middle East appears to have Beijing’s political backing, considering the endorsements by state media and attendance of senior Chinese diplomats at such functions.

Media coverage from early 2022 described Huawei as enjoying a “honeymoon” period in the Gulf after winning significant 5G and smart cities contracts in Saudi and the UAE, which was linked to the company being shunned by Western countries and its search for new markets. Gulf governments were said to value the surveillance technologies often embedded in Huawei’s service offering, something that Western firms open to public and government scrutiny are hesitant to offer. For more in-depth coverage on Chinese tech activity in the Middle East as part of the “Digital Silk Road” initiative, tune in to the first episode of our podcast, which will be released later this week.

References:

https://www.datacenterdynamics.com/en/news/huawei-plans-to-build-a-cloud-region-in-saudi-arabia/

https://mei.edu/sites/default/files/2021-03/Chinese-Tech.pdf