Russia Trip Report – Economic insights and other titbits (Part 2)

Chinese manufacturers stepping in to get Muscovites from A to B amid sanctions

In late July/Early August, Altraman spent two weeks in Moscow, the capital of Russia. In this instalment, his exploration of the city provided valuable insights into how Russia looks to China to power its transport and supply vehicles as Western players turn their backs.

This is Part 2 of a four-part Series covering Altraman’s recent trip to Moscow from Hong Kong, during which he uncovered many ground truths about the economic situation there, as well as insights into the workarounds being used to keep businesses open and money flowing amidst increasingly hostile sanctions. Few aspects of life in Russia appear untouched by the current geopolitical climate, which was evident even during Altraman’s journey to the country. Hence the second piece in this series will explore how Russians travel from point A to B and a brief overview of the state of the local car market in Russia.

Spoilt for choice in getting around the megalopolis

My last visit to Moscow was 8 years ago…the two things that stood out to me at the time were:

The lack of English knowledge.

The amount of time needed to get from A to B.

On point 1, one would have thought post Russia hosting the World Cup in 2019 that it would be much easier to communicate…well, I was sorely mistaken. Younger people have a good command of English, but given the vast urban sprawl and lack of density in the suburbs, one doesn’t frequently bump into helpful young strangers outside the city centre.

Point 2 is less of an issue nowadays with the proliferation of scooters (самокат) around the city through super apps like YandexGo, operated by Yandex (YNDX.O, YNDX.MM), or dedicated apps like Woosh, operated by recently IPO’ed Whoosh Holdings (WUSH.MM). While the former is suspended in overseas market, it continues to trade on the Moscow Stock Exchange. Both these companies (and stocks) are doing well and remain an integral part of the Moscow day-to-day transport ecosystem.

Widespread Use of Yandex Scooters Prompts a Look into the Stock

Scooters can be found and parked anywhere in the city. Yandex’s fleet appears to be mostly produced by Ninebot, a subsidiary of Xiaomi (1810.HK). Despite talk of shifting to locally produced models back in 2019, I did not see these in use during my visit. You can locate scooters through apps like YandexGO or Whoosh, scan the scooter to start using it, and pay USD 0.01 per minute until you scan out, after which your (local) card tied into the app will be charged.

Yandex navigated the challenges of 2022 without significant losses, strengthening its position in advertising, taxi services, and food and grocery delivery. Despite ongoing uncertainty regarding its planned reorganization, Yandex remains significantly undervalued, with capitalization having decreased threefold from its peak. The stock’s growth prospects remain promising with forecast average annual topline growth of around 21% over the next four years and a potential doubling of its EBITDA margin (currently fallen to about 10%).

Over the next two years, revenue is expected to be driven largely by its taxi and e-commerce segments (combined 53% of revenues). Market diversification will likely reduce its share of search and advertising revenues (combined 42% of revenues), while investment and other initiatives (8% of revenues) may initially decrease profitability. It’s noteworthy that over the past 10 years Yandex has grown its revenue and net profit at ~30% and ~11% CAGR, respectively. Average forward EV/Sales, EV/EBITDA, and P/E during that period was 5.8x, 23.4x and 36.7x respectively. As of yesterday’s close of RUB 2,691.00, it trades at around 1.3x, 8.7x and 15.3x respectively.

Metro remains king

As I learned the hard way through sitting in endless traffic, the metro system remains the best way to cover longer distances. While it might be easy and quick to order a taxi off Yandex, the cost of getting to places in Moscow becomes equivalent to Hong Kong taxi prices (which to be fair, are reasonable for the developed world) when accounting for traffic jams. For the metro, you can get yourself a Troika Card (Тройка), a contactless reusable card and travel anywhere for a fixed cost of USD 0.50.

It was also interesting to see Moscow’s facial recognition payment system, Face Pay in play, which is now available across over 240 metro stations. The system was used 32 million times in 2022, with over 220,000 new users having registered on the system. While a very impressive system, it is currently only used by 2% of annual ridership. I would be curious to see how the practicality and overall acceptance among the general population of this system plays out over the next few years given security and privacy concerns.

Sign of things to come with growing electric bus deployment?

Walking around the city streets, the prevalent use of electric busses caught my eye. Moscow currently runs 1,055 electric buses on 79 routes. Just this year, Moscow plans to install nearly 200 ultra-fast charging stations for the electric buses and launch 29 more routes. The eventual aim is to fully electrify the fleet by 2030. The city of Moscow has signed a contract for 1,000 electric buses from KAMAZ (KMAZ.MCX), with plans to purchase an additional 200 from GAZ Group (GAZA.MCX). The vehicles will come to the capital over the next two years. According to a Russian government announcement, around 830 electric busses will be rolled out across other cities this year, although the manufacturer is not specified.

However, given the slow general uptake of EVs in Russia (0.13% of new sales in 2021), we believe that moves such as a limited electric bus rollout are largely geared towards optics. Given Russia’s abundant supply of cheap hydrocarbons, there is little impetus for wider uptake among the general population.

In another likely symbolic move, the Russian government announced in 2021 that a 25% subsidy would be provided for electric vehicles manufactured in Russia (with the only catch being that there was no domestic production at the time).

Should this change, Chinese battery and EV manufacturers would no doubt benefit from the new market. Dongfeng Motor (0489.HK) has already stepped into a JV with Motorinvest to start producing EVs in Russia, with the first models hitting the market this month. Interestingly, Motorinvest claims that it is in negotiation with Yandex for these vehicles to be used in taxi services.

Russian market a bright spot for Chinese automakers?

During my trip, I got the sense that the local EV scene is far too immature for investment, and we would need to see further manufacturing capacity come online and government incentives before taking a closer look. One thing that did catch my eye - imports of conventional Chinese vehicles have shot up (up 543% in H1 2023 now accounting for 70% of market, compared with 10% pre-2022) as western manufacturers turn their backs. Russia is now the number 1 importer of Chinese autos - a trend already visible on Moscow’s crowded highways, which no doubt helped China leapfrog Japan as the world’s biggest auto exporter in Aug 2023.

One Chinese player that has really capitalized on the Western automobile exodus is Great Wall Motor (2333.HK; 601633.SS, “Great Wall”) with Russia sales contributing 6% of total group sales in FY22. Great Wall’s Russia sales have already increased 73% yoy from CNY 4.97 billion (USD 700 million) in FY21 to CNY 8.58 billion (USD 1.2 billion) in FY22. The Company has set up three full process local production bases with capacity of 80,000 vehicles per year. The utilisation rate of production capacity was only at 28% last year, providing ample room for revving up output.

As of 30 June, Great Wall holds a 16% market share in Russia, second only behind domestic leader Lada at 40%. In July, Great Wall’s sales increased another 18% MoM, owing to 9,488 sold units of its Haval model and new launch of its premium SUV line – Tank, with already 1,647 units sold for the month.

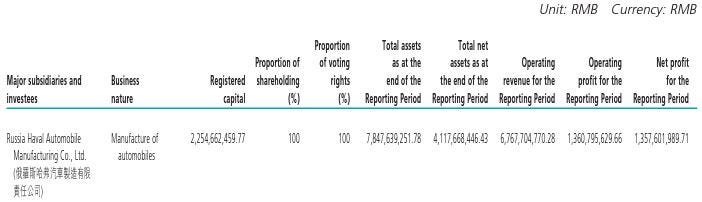

On 30 August, Great Wall reported their H123 (January - June) results, which showed its wholly owned subsidiary Russia Haval Automobile Manufacturing achieved CNY 6.76 billion (USD 946 million) in sales, with an operating profit of CNY 1.361 billion (USD 190 million). Interestingly, that figure was above the Company’s total operating profit for the half, which stood at CNY 1.22 billion (USD 170 million). The Russia segment continues to play a significant role in driving overseas sales, which surged by 122% year-on-year to reach CNY 20.67 billion (USD 2.89 billion). This accounted for 30% of Great Wall's total revenues of CNY 69.97 billion (USD 9.79 billion), representing a 10% share of the company's overall revenue.

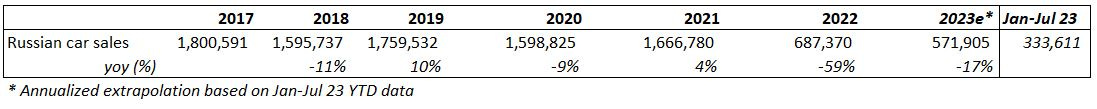

Given the void in the Russia automobile industry left by Western and Japanese / Korean automakers, car sales by volume are currently only one-third of their pre-war levels. In this context, we believe that Great Wall is well-positioned to gain market share in the coming years by filling the supply gap as consumers are likely to give up hopes of lifted sanctions.

If the Russian industry rebounds to around 1.6 million car sales annually, and assuming Great Wall captures 25% of that market share (depending on the product mix), they could easily generate sales of over CNY 50-60 billion (USD 7.0-8.4 billion) per year and achieve earnings of around CNY 3-4 billion (USD 420-559 million). This would contribute to more than 30-40% of Great Wall’s future earnings, assuming a conservative net profit margin of 6.5% (the achieved margin in FY22A). It is noteworthy that they achieved 20% net profit margin in H123A although it is not clear whether it has been adjusted for any grants or FX gains (it would be more than a bright spot if they can maintain that moving forward).

Great Wall’s domestic position and valuation

Of course, this exciting overseas growth needs to be looked at through the lens of events back home. Domestically, the Company continues to navigate through tough competition in a weak, but improving consumer environment. Group NPAT in Q223A saw a significant 582% qoq rebound to CNY 1.19 billion, but still down (75.7%) yoy for H123A. The Company is actively optimizing its NEV model structure, aiming for completion by October next year for most vehicles (excluding Pickup).

The market currently shows little faith in Great Wall's EV transition as reflected in its valuation. Our back of the envelope sum of the parts SOTP valuation leads us to a target price of HKD 12.00, suggesting a 13.2x estimated implied P/E, comparable to Geely (another leading automotive player in Russia). Great Wall's projected FY24e P/E trades at a 26% discount to Geely’s. Despite recent profit declines negatively impacting market sentiment, the Company’s strategic steps such as new EV launches and improvements in retail infrastructure signal potential growth and profitability. The prospect of rising margin-accretive exports to Russia and elsewhere in the coming years provides room for additional upside. As such, we believe now is an opportune time to take up a small position in Great Wall, adding yet another pick to our portfolio inspired by ground truths observed during the trip to Moscow.

Currently, we do not hold shares of Great Wall Motor (2333.HK; 601633.SS), but will look to establish a small position in the (H-shares of the) Company.

Disclaimer: This research piece above is for informational, entertainment, educational, and/or study or research purposes only. The information contained herein or discussed does not, should not, and cannot be construed as or relied upon and, for all intents and purposes, does not constitute or provide professional financial, investment, or any other form of advice. This research does not and should not be construed as an offer to sell or the solicitation of an offer to buy any securities or any other financial instruments in any jurisdiction, including where such actions are illegal. This research is not intended for publication in jurisdictions where it would violate laws. The research does not consider individual investment objectives or financial positions and merely expresses the opinions of its authors. Any investment involves taking substantial risks, including (but not limited to) the complete loss of capital. Every investor has different strategies, risk tolerances, and time frames. You are advised to perform your own independent checks, research, or study, and you should consult a licensed professional before making any investment decisions. The assumptions and parameters discussed or used are not the only reasonable ones, and no guarantee is given for their accuracy, completeness, or reasonableness. No promise is made that any indicative performance return will be achieved. The research is derived from public information sourced by Pyramids and Pagodas. No representation or warranty is given for the reliability, completeness, timeliness, accuracy, or fitness of this research, nor is any responsibility or liability accepted for any loss or damage. The authors (Pyramids and Pagodas) shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Great insight Altraman!

Loved this - great work, Altraman!