Russia Trip Report – Economic insights and other titbits (Part 3)

Major western retailers and fast-food chains head for the exits while local brands step in

In late July/Early August, Altraman spent two weeks in Moscow, the capital of Russia. In this instalment, his exploration of the city provided valuable insights into how local consumers are adjusting to the changing geopolitical landscape.

This is part 3 of a four-part Series covering Altraman’s recent trip to Moscow from Hong Kong, during which he uncovered many ground truths about the economic situation there, as well as insights into the workarounds being used to keep businesses open and money flowing amidst increasingly hostile sanctions. Few aspects of life in Russia appear untouched by the current geopolitical climate, which was evident even during Altraman’s journey to the country. Hence the third piece in this series will explore the retail and F&B space to see how consumers and businesses are adjusting to more restricted options.

Foreign chains leave, local alternatives slowly filling the void

As I toured Moscow, I was surprised to see KFC (YUM.N), Burger King (QSR.N) and Subway still operating in the market. But nothing beats Vkusno I Tochka (Вкусно – и точка), new local iteration of McDonald’s, with a menu that largely consists of rebranded McDonald’s items. Food options are vast, affordable, and significantly healthier (wraps and salad options too) than any McDonalds stores I’ve had tried globally to date. I don’t say this lightly as a McDonalds connoisseur. A Big Mac (large) meal equivalent costs roughly USD 4.50.

Putting aside my high-end gastronomical adventure, a walking around the ritzier parts of the city one could see how well-heeled shoppers might find more difficulty in replacing their go-to brands. The majority of high-end Western clothing brands such as Fendi and Dior (DIOR.PA) have already left the country, with those spaces yet to be filled by local players.

The Russian fashion market is undergoing a structural reset, marked by the closure of over 700 foreign retail stores. This reset, which began in 2022, is gaining momentum. As a result, leading Russian fashion brands like Sportmaster, Gloria Jeans, and Detsky Mir (DSKY.MM) are experiencing sales growth of 10-20% and dominating both offline and online trade. This shift is accompanied by a return to department and multi-brand stores occupying spaces left by foreign chains.

My sense is that local brands may struggle to match the same “prestige” associated with foreign brands, but that won't stop them from gaining market share owing to a shift in consumer demand towards mass market. This is primarily due to a decrease in real incomes and the departure of foreign companies are predominantly in the middle price segment. Interestingly, Eurostat shows that Italy and Germany are still the main trading partners of Russian fashion retailers. Products do still come in directly or via parallel import schemes although in smaller quantities given the lack of the luxury brand stores.

According to INFOLine, the share of Russian clothing and footwear in the market in 2022 increased from 20% to 30%, while imported goods decreased to 70%. In the import structure, 53% comes from China, 40% from Asia and CIS countries and EU makes up the last 7%.

On the other hand, the premium clothing and footwear market remains stable, but declining (from 10% to 8% in 2022) resulting from the exodus of high-end European and American brands. However, domestic luxury Russian brands such as Artic Explorer or decor brand Viva Vox are gaining foothold. A popular mechanism for local consumers to source products from the likes of Chanel, Gucci (PRTP.PA) and Louis Vuitton (LVMH.PA) are through online re-sale platforms.

Highly concentrated e-commerce space sees explosive growth

Based on my experience on the ground and the accounts of others I spoke to, an increasing number of consumers are turning online to source clothing, footwear, and other goods. According to Data Insight (RU), the e-commerce accounted for 15% of all retail sales in 2022, up from 5% in 2018. In 2022, the market’s value increased by nearly 40% yoy, reaching RUB 5.7 trillion (USD 58.9 billion). Pockets of entrepreneurship continue to thrive under a tough external environment. The mass exodus of multinationals created an opening for a company like Wildberries.ru (private) to expand its market share, particularly in areas such as clothing, cosmetics, and food products.

Wildberries is one of the largest e-commerce companies in Russia, operating with a unique hybrid business model. It combines online retail with an extensive offline logistics infrastructure and retail stores. The stores serve as pickup points for customers to collect their online orders in person. Customers can also visit stores to try on items and decide whether to purchase.

Founded in 2004 by Tatyana Bakalchuk during her maternity leave, Wildberries started with a team of four people and a budget of only USD 700. Today, Bakalchuk owns 99% of the company stake, making her one of Russia's richest women according to Forbes (estimated net worth of USD 7 billion). The company has grown exponentially under her leadership while remaining privately held, as Bakalchuk is strongly against plans for an IPO.

In 2022, the company is ranked first in Russia by revenue, achieving RUB 317.2 billion (USD 3.3 billion) with RUB 10.1 billion (USD 103 million) in net profit. It has monthly visits of 324.9 million worldwide and over 21,000 pickup points across Russia.

That said, look no further than the second largest online marketplace Ozon (OZON.MM; Nasdaq de-listed), which is listed on the Moscow Stock Exchange to take a stab at the country’s growing e-commerce scene. The company also has operations in Belarus, Kazakhstan, and Kyrgyzstan. The key differentiator for Ozon is that it operates as more of an independent “pure-play” online retail model without owning physical stores, relying on partnerships with logistics companies for fulfilment and delivery across Russia.

Ozon shares similarities to Taobao (BABA.N; 9988.HK), but the former also owns proprietary inventory as an online retailer, which on its own has some risks relative to a marketplace model. Back in 2021, the company reached breakeven for the first time in 20 years and could have been profitable, but management decided to invest in logistics infrastructure, IT and new business initiatives. Ozon looks to develop in the same way as Amazon (AMZN.N), which became profitable, though not immediately, after introducing digital services.

Ozon endured a tough FY22, with a bond freeze, NASDAQ de-listing, billions in losses from a warehouse fire and threat of default. Despite this, the company's GMV including services grew by 86% yoy to RUB 832.2 billion (USD 8.6 billion) and total sales by 55% to RUB 277.1 billion (USD 2.86 billion). Number of orders and active buyers on their platform jumped 108% yoy to 465.4 million, and 38% yoy to 35.2 million respectively.

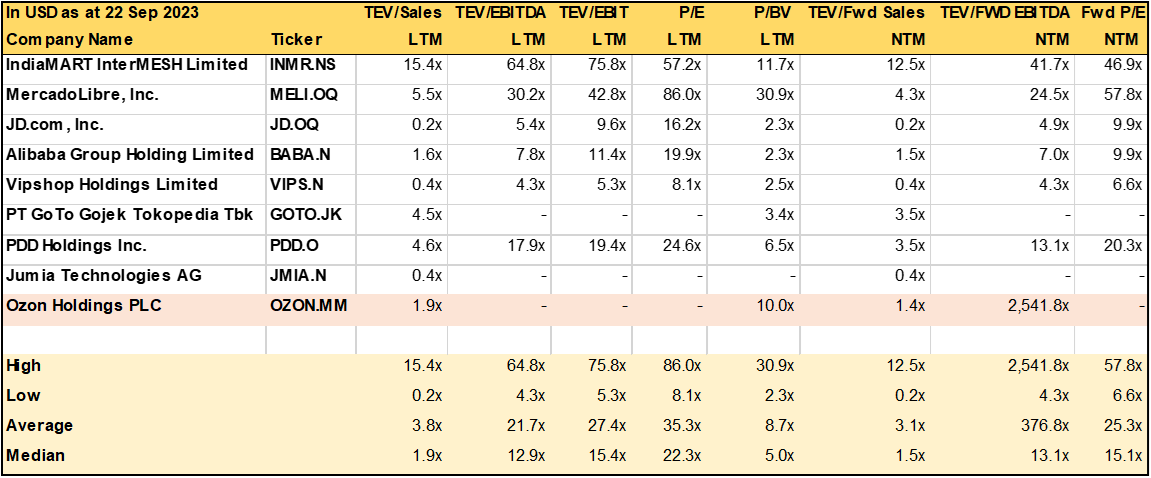

Ozon’s adjusted EBITDA loss decreased to (RUB 3.2 billion) (USD 33 million) from (RUB 41.2 billion) (USD 426 million) in FY21, and NPAT loss remained stable at (RUB 58.2 billion) (USD 601 million). The company is well capitalized and set course for self-sufficiency. Ozon recently raised its guidance for the FY23 in the interim, with GMV including services expected to increase by 80% to 90% yoy and adjusted EBITDA to be positive for the FY23 - an inflection point in the business. As of 22 September 2023 close of RUB 2,586.00, the stock trades at EV/Forward GMV of 0.4x and EV/Forward Sales of 1.4x. The latter suggests a 54% discount compared to a select group of emerging market peers, making it quite interesting considering its significant runway for potential growth.

Disclaimer: This research piece above is for informational, entertainment, educational, and/or study or research purposes only. The information contained herein or discussed does not, should not, and cannot be construed as or relied upon and, for all intents and purposes, does not constitute or provide professional financial, investment, or any other form of advice. This research does not and should not be construed as an offer to sell or the solicitation of an offer to buy any securities or any other financial instruments in any jurisdiction, including where such actions are illegal. This research is not intended for publication in jurisdictions where it would violate laws. The research does not consider individual investment objectives or financial positions and merely expresses the opinions of its authors. Any investment involves taking substantial risks, including (but not limited to) the complete loss of capital. Every investor has different strategies, risk tolerances, and time frames. You are advised to perform your own independent checks, research, or study, and you should consult a licensed professional before making any investment decisions. The assumptions and parameters discussed or used are not the only reasonable ones, and no guarantee is given for their accuracy, completeness, or reasonableness. No promise is made that any indicative performance return will be achieved. The research is derived from public information sourced by Pyramids and Pagodas. No representation or warranty is given for the reliability, completeness, timeliness, accuracy, or fitness of this research, nor is any responsibility or liability accepted for any loss or damage. The authors (Pyramids and Pagodas) shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.