With the Russia-Ukraine conflict in full effect, we pick up where we left off early March by flagging an interesting geopolitical development that could shape the balance of 2022.

We noted in our previous post in January that we are likely to see multi-currency energy pricing gain more traction, much of it stemming from China’s economic needs.

Over time China seeks to reduce the dependency on USD to buy oil globally, resulting in less USD demand in the longer term. China has already launched initiatives to conduct Renminbi-denominated trade with several Middle Eastern partners, although this remains at a nascent stage.

Quote from Pyramids and Pagodas: Overview and takeaways on Chinese commercial activity in the Middle East and beyond #1

On 15 March 2022, Bloomberg reported that Saudi Arabia is in talks with Beijing to accept CNY instead of USD for some of its oil sales in China. While these talks have been active for the past six years, we believe the mood in Saudi Arabia has shifted since beginning of the Russian-Ukraine conflict. The Western media has been quick to point out the Kingdom’s frustration with the US government’s position on the Yemeni civil war, Iran nuclear deal talks, and US withdrawal from Afghanistan. However, more pessimistically, we think that Riyadh may be nervous to see the US sanctioning of Russian FX reserves, which may have triggered such a development.

The unintended consequence is an effective announcement to the world that FX reserves abroad are not safe and subject to seizures or freezes by the US and EU. We think weaponization of money at this scale can only be deployed once; countries looking at this will be contextualizing USD hegemony when dealing with their own internal affairs.

Quote from Pyramids and Pagodas: Impact of Sanctions on Russia Fades Amid Shifting Sands of New World Order?

It wasn’t that long ago when the Biden Administration promised to make a pariah out of Saudi Arabia over the 2018 killing of dissident Saudi journalist Jamal Khashoggi. While few of these threats came to fruition, they certainly ruffled feathers in Riyadh and Saudi policymakers are now wary of punitive actions by the US vis-a-vis future foreign policy decisions taken by the Kingdom. The US has made it abundantly clear that it could seize foreign assets of countries falling foul of US foreign policy imperatives. This development plays into China’s hand given their lack of interest in policing foreign affairs and human rights issues to date. Under this backdrop, we are beginning to see an acceleration of commercial interests dominating political affairs, particularly in key areas such as oil and gas.

Bloomberg (15 Mar 2022) - Yuan Surges after Report on Saudi’s Accepting Currency for Oil;

Saudi Press Agency (10 Mar 2022) - Aramco JV to Develop Major Refinery and Petrochemical Complex in China

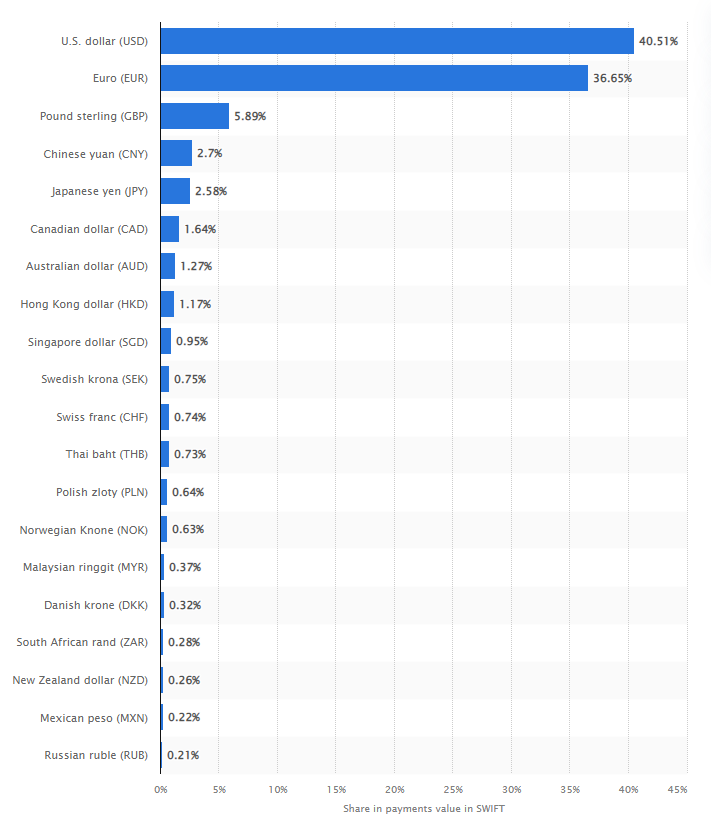

We note that WSJ and Bloomberg were also quick to point out that Saudi Arabia’s switch to CNY for oil is more symbolic, and not a true threat to the dollar. And while it is true that USD trading dominates all other currencies as per our charts below, the reality is always more nuanced and not a simple debate of CNY vs USD.

There are alternative benefits of Saudi Arabia holding onto CNY. To date, foreign dollar surpluses have typically been recycled back into US financial assets and treasuries. Why can’t Saudi Arabia spend their CNY on investing in domestic and foreign (China) infrastructure, as well as buying Chinese assets? Saudi Arabia is becoming an increasingly important investor, after having previously played a limited role in China’s growth story, and its interest in China’s downstream hydrocarbon sector is a noteworthy trend. It is worth mentioning that Bloomberg reported in November 2021 that the Kingdom’s USD 450 billion sovereign wealth fund (Public Investment Fund – PIF) had applied for a Qualified Institutional Investor license in China. This would give them the ability to directly invest in CNY-denominated stocks, rather than having to go through third parties.

Quite forward thinking on the Saudis’ part for diversification. It is certainly more enticing than holding US treasuries (negative real rates) as a reserve asset, especially considering both US and EU governments can seize sovereign reserves at a blink of an eye. It is without a doubt the same argument could be made about China potentially seizing sovereign assets, while the lack of free capital flows and the idea of holding Chinese bonds (being further up the risk curve) are less appealing. However, Saudi Arabia may have been given some food for thought knowing that CNY reserves are available for the Kremlin despite the barring of Russian sovereign assets. On balance, we think the synergies gained would outweigh Chinese political and regulatory risks given China is the Kingdom’s biggest trading partner.

Bloomberg (4 Nov 2021): Saudi Wealth Fund Moves Step Closer to Direct China Stock Deals

Saudi Arabia’s tilt towards China also plays well into the Saudi Vision 2030, which is a strategic framework erected by the Saudi government to reduce the Kingdom's dependence on oil, diversify its economy, and develop public service sectors. The PIF has ambitions to control USD 2 trillion of assets, but most of its public investments have been in the US and EU. The ability to draw on foreign investments including Chinese bonds and equities to realize its vision would be a net benefit to the Saudis, and positive for Chinese financial markets, which has been battered as of late. While it would be disingenuous to simply say that Saudi Arabia is China’s savior, the acceleration of bilateral developments are means for China to address its inherent economic weakness, as its financial and political risk profile rise amidst negative externalities.

We won’t hold our breath on this development occurring in the coming months, but anything is possible under the current climate. In general, China has been walking a tight rope in keeping their borders closed, while making sure they can control the detonation of its property sector. February 2022 sector data reflect a very weak property market, while key developers’ situation is likely even worse. With real estate accounting for 29% of China’s GDP, we think the State Council’s 5.5% GDP growth target is probably a bit too optimistic particularly under tight monetary and closed borders policies. In addition, renewed COVID-19 outbreaks across the country are suppressing a wide range of sectors, including in-person services, construction, and some manufacturing activity. We also think that it is unlikely that China will open to the world until June 2023 when President Xi becomes the defacto leader, which puts further pressure on the government to stimulate economic activity.

National Bureau of Statistics: Jan-Feb 22 National Real Estate Data

From a strategic asset allocation perspective, we hold that gold and gold miners is a must have. Where China is concerned, a lot of sectors are facing worsening competitive landscapes, but do see some interesting names that are trading at discounts. With global markets down across the board, companies with high certainty in earnings and growth are a priority. Outside of gold, we like industrials, infrastructure, utilities, and fertilizer equities; perhaps even ones that would benefit from the Saudi Vision 2030 investment case. We plan to raise some specific (equity) considerations in subsequent write-ups.