Softcare Limited (2698.HK) – A formidable fortress in Africa finding its footing

Rare HK-listed frontier market pure play on consumer hygiene

Genuine, investable plays on frontier market consumption are rare. Rarer still are companies that build unassailable local advantages rather than merely exporting to them. Softcare Limited (2698.HK; “Softcare”), the leading diaper and sanitary pad manufacturer operating in the world’s last high population growth region recently listed in Hong Kong and fits the bill. In this piece, we focus largely on its core diaper segment as it’s the bulk of the Company’s business, although other segments hold promise, as we discuss later.

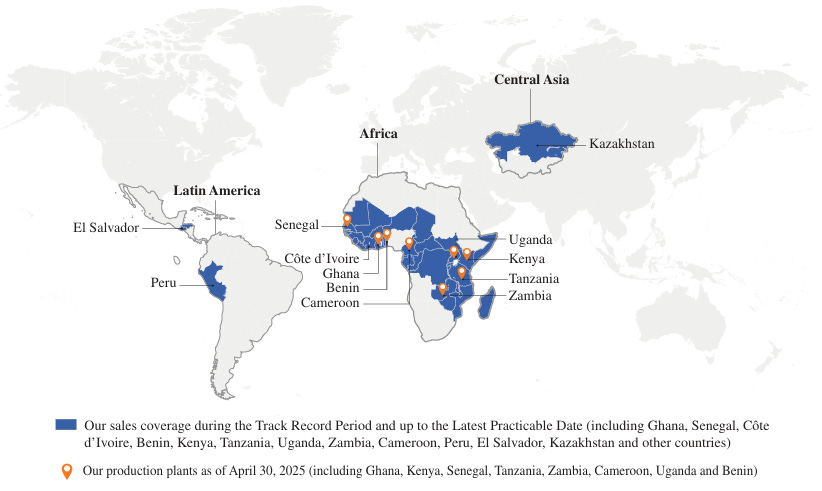

Founded in 2009 as a trading arm of the Sunda Group (“Sunda”), Softcare with a market cap of around USD 2.6 billion, has evolved into a local manufacturing champion in Africa. It has captured a 20% market share by volume, built eight local production plants, and established a robust distribution network on the continent – advantages that are not easily replicated in Africa’s highly relationship-driven FMCG sector.

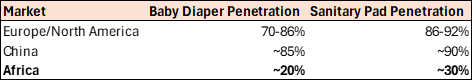

The Company derives the majority of its sales from Africa. Its strategy moves beyond treating the continent as a simple export destination. By localizing production, it provides low-cost diapers in a market of unparalleled demographic scale: Sub-Saharan Africa accounts for 36% of global births, yet diaper penetration sits at just 20%, compared to 70-86% in developed markets.

Softcare listed on HKEX in November 2025 at HKD 26.20, and now trades at HKD 32.76 (as at 18 December 2025), roughly 25% above the IPO price. At current prices, does the opportunity still exist?

From Yancheng to Lagos – A contrarian bet on a forgotten continent

In 2000, as China’s export engine roared toward Western markets, husband-and-wife team Shen Yanchang and Yang Yanjuan, formed Sunda and looked decisively South. From their base in Guangzhou, they focused on Africa – a region many multinationals considered too poor, fragmented and difficult.

Their education began in the chaotic, vibrant markets of Nigeria. Starting as a trader of general merchandise, Sunda navigated unreliable supply chains and learned that in Africa, business is built on layered, personal relationships and a keen understanding of opaque regulations. They discovered a fundamental truth: the company that masters the complex, multi-tiered distribution puzzle owns the market.

Rather than relying on established top-tier distributors, Sunda took a harder path. They went directly into communities to cultivate smaller, second-tier agents and local shop owners. They supported these partners by absorbing initial product losses, helping build out retail shops, and running local advertisements – a grassroots strategy that steadily wove a deep, resilient, and uniquely loyal sales network.

This distribution-first philosophy became Sunda’s foundational moat. By 2004, the Group had planted its flag with an overseas subsidiary in Ghana, marking the start of a physical presence that would expand across the continent.

For years, Sunda operated on a classic trade model: import goods from China and sell them through its hard-won African network. However, the limitations of this approach (high tariffs, long shipping times, and currency risks) soon became apparent.

The Group’s pivotal strategic shift was to localize production and the value it created set the stage for a major corporate reorganization. To raise funds and expand the footprint further, Sunda carved out this business into a separate entity named “Softcare Limited” that listed in Hong Kong in November 2025.

Africa’s hygiene paradox: Immense penetration gap amid demographic tailwinds

Softcare’s own financials, while compelling, don’t tell the full story. The Company is uniquely positioned to tap into the vast underserved African market, where hygiene products are still in the early stages of adoption. That gap, combined with rapid population growth, urbanization, e-commerce growth, and shifting social norms, is what makes the macro story a key differentiator in Softcare’s value proposition.

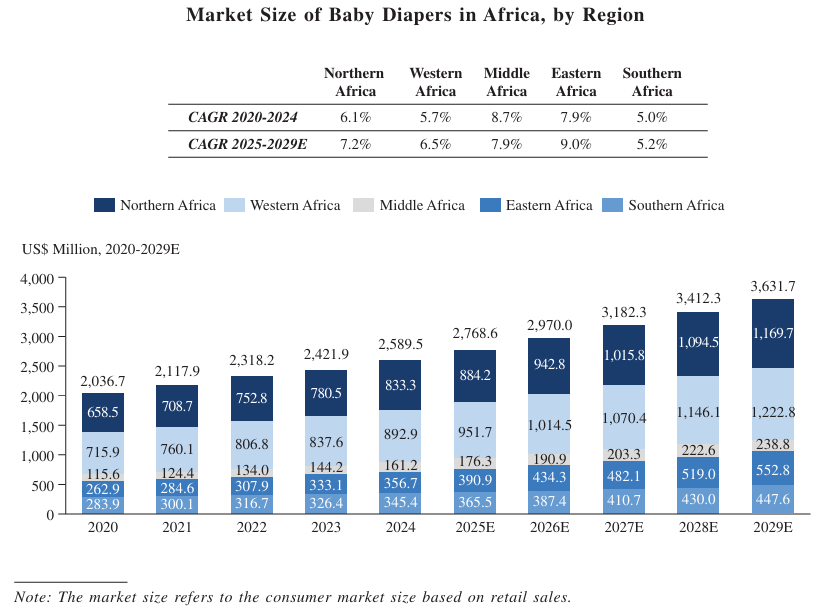

This baseline convergence drives steady, predictable market growth. Frost & Sullivan projects the African baby diaper market to grow at 6.8% annually to USD 2.9 billion by 2029, with sanitary pads growing even faster at 7.2%. These projections don’t require economic miracles, but rather the gradual normalization of consumption patterns.

The Company states that the African market for its products is worth USD 3.8 billion and is growing at 6.8%, expected to rise to 7.9% in 2029, positioning it well against peers specializing in lower growth markets like in Europe (0.7%), US (1.2%), and China (1.2%), where populations are ageing and distribution networks are mature, and the products are hardly novel.

The opportunity is stark: while 36% of global births occur in Sub-Saharan Africa, baby diaper usage sits at just ~20%, compared to 70-86% in developed markets. Sanitary pad penetration is only ~30%.

Demographics maintain consumer base growth

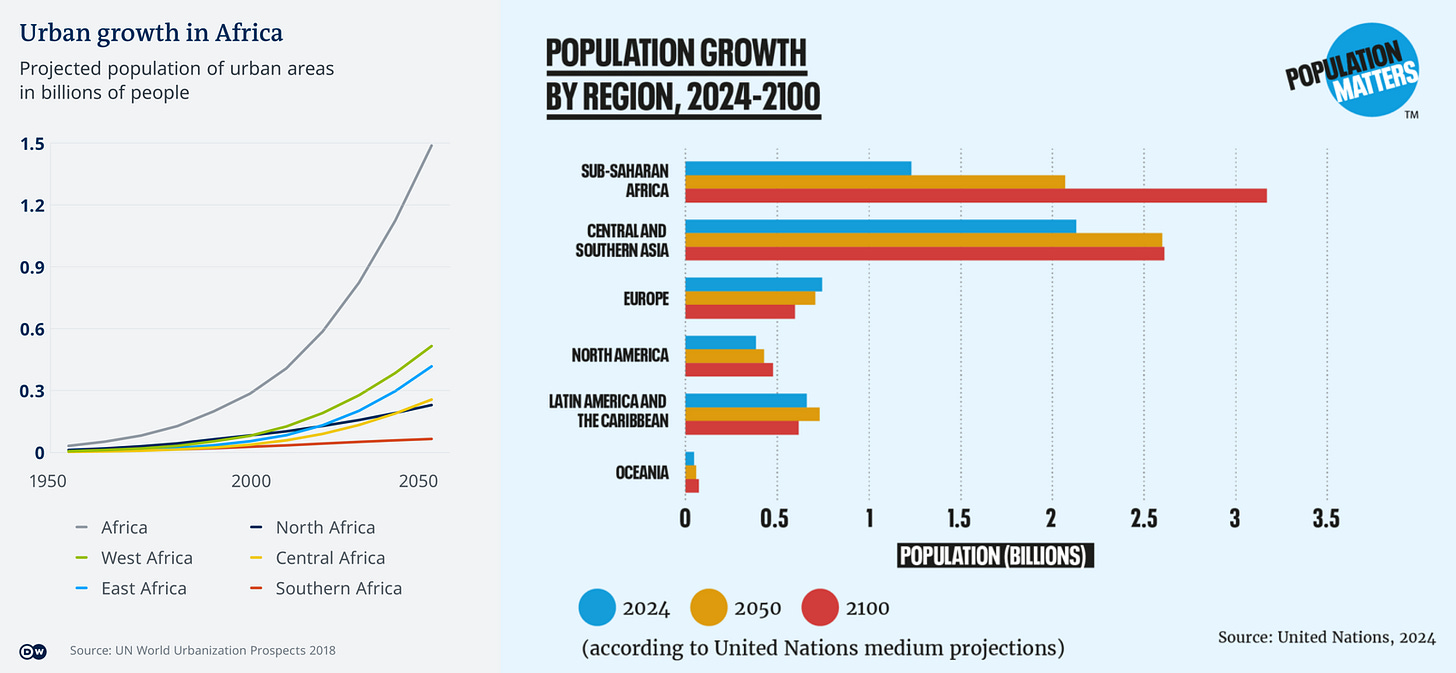

Africa has the youngest demographics and fastest population growth of any continent. 14% are under the age of four, 60% are under 30, and population growth of ~2.4% offers a steady pipeline of diaper demand. With over 30 million newborns annually, the baseline market expands even before penetration gains are factored in.

Urbanization and e-commerce unlock access

While Softcare’s distribution reach is expanding beyond large cities, these hubs themselves are seeing population influx. According to the UN, Africa’s urban population is projected to double to 1.5 billion by 2050, with 64% living in cities. Urban households have easier access to retail outlets, pharmacies, and e‑commerce platforms, while rural logistics can add 30%+ to product costs.

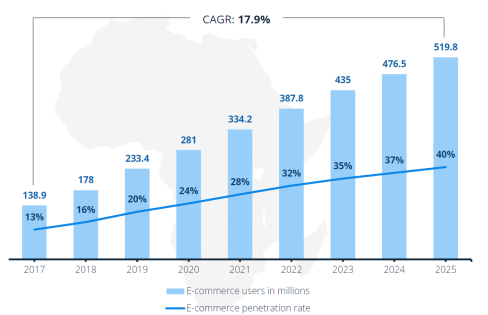

E-Commerce itself is also a promising direct sales avenue for Softcare, with channel expansion noted among the Company’s strategic platform. Adoption is only just taking off, and user numbers are already growing at 17.9% CAGR according to the US International Trade Administration. A quick review of leading platforms showed their brands already have healthy representation online, although in many cases they appear sold by third-party distributors.

Rising incomes drive premiumization

The World Bank expects Africa’s consumer spending to reach USD 2.5 trillion by 2030, up from USD 1.4 trillion in 2015. Softcare’s core markets show steady GDP per capita growth. While not world-beating at first glance, the figures are solid: Ghana (3.7%), Senegal (4.4%), Côte d’Ivoire (3.4%), Kenya (2.5%), Tanzania (2.6%), and Uganda (3.3%). As incomes rise, an increasing number of consumers will switch to higher quality diapers and pads with comfort, absorption, and skin‑friendly materials.

The Prospectus claims that sustainability concerns are driving demand for eco-friendly products, but we see this as more PR spin than reality in these price-sensitive markets.

Sociocultural shifts to drive sanitary product adoption

Softcare’s sales of menstrual products are also set to benefit from shifting cultural attitudes. In many African countries, women stay home from work or school due during their periods due to social taboos. Awareness campaigns and NGO initiatives are breaking the stigma and urbanization and growing GDP are driving more women into the workforce, driving general demand uplift for sanitary product on the continent.