Overview and takeaways on Chinese commercial activity in the Middle East and beyond #9

1 Sep - 30 Sep 2022

Apologies for the late September round up…it’s been a busy month for both me (@TheAltraman) and @DesertFox. Please enjoy some of the stories we came across and our take on developments for balance of the month. For the record (for newcomers), we are not macroeconomists…our readers or subscribers know that we do this out of our own time because we enjoy sharing our insights on interesting key macro and geopolitical events, business stories and data points that we ourselves compile and contextualize to try help tune into (market) trends/signals.

CONTENTS

1) 2022 Shanghai Cooperation Organization Meeting in September – A Shoring up of “Friendly Currencies”

2) Israel and China Likely to Sign Free Trade Agreement Late 2022

3) Turkey’s Middle Corridor and Compatibility With Belt and Road Initiative

1) 2022 Shanghai Cooperation Organization Meeting in September – A Shoring up of “Friendly Currencies”

The Shanghai Cooperation Organization (SCO), which was established on 15 June 2001 is an intergovernmental organization focused on economic, military, and cultural cooperation between China, Russia, and Central Asia countries. As a reminder, the SCO comprises of 8 member states namely, China, India, Kazakhstan, Kyrgyzstan, Russia, Pakistan, Tajikistan, and Uzbekistan. There are 4 Observer States looking to attain full membership (Afghanistan, Belarus, Iran, and Mongolia) and 6 Dialogue Partners (Armenia, Azerbaijan, Cambodia, Nepal, Sri Lanka, and Turkey). Iran is in the process of becoming a full SCO member, while Egypt, Qatar, and Saudi Arabia became Dialogue Partners.

The 2022 SCO meeting was held on 15-16 September in Samarkand, Uzbekistan. Much of the press focus was overshadowed by President Xi and Putin’s bilateral meeting, and the ongoing Russian-Ukraine conflict. However, the conference did shine a positive light on Uzbekistan’s growing economy (the Asian Development Bank had recently raised its 2023 GDP forecast to 5%), which should see ongoing foreign investment into the country:

China and Uzbekistan agreed to increase bilateral trade from USD 8 billion in 2021 to USD 10 billion in 2022

China, Kyrgyzstan, and Uzbekistan sign agreement to pursue construction of a railroad across Kyrgyzstan to further integrate the regional economies of Central Asia, thereby lowering logistics costs.

We would be curious to learn more about Uzbekistan’s growth prospects and will look more into this in a future edition.

However, the key highlight for us would be that:

“the leaders of SCO agreed to take steps to increase the use of national currencies in trade between their countries” in a joint declaration. The group - which comprises China, India, Russia, and Pakistan alongside four Central Asian states - said "interested SCO member states" had agreed on a "roadmap for the gradual increase in the share of national currencies in mutual settlements", and called for an expansion of the practice.” Reuters article

Moscow has been the key proponent for less reliance on Western currencies in trade, namely the dollar. Bloomberg had reported earlier in September that Russia was considering buying as much as USD 70 billion in Yuan and other “friendly” currencies this year to contain its currency surge, before shifting long-term towards selling its Yuan holdings to fund investment.

It was also reported in September that Gazprom (effectively Russia) is shifting gas sales to China to Rubles and Yuan from Euros…

Relating back to the two previous points, Russia can use Yuan to buy Chinese goods. On that front, Russia’s VTB Bank became the first Russian bank to launch money transfers to China in Yuan without using the international SWIFT system. In addition, Sberbank has already started lending in Yuan.

Looking further into Moscow’s dealings with SCO members, we would add that India is opening special rupee accounts to handle Russia-related trade settlements in the local currency. President Putin also announced several weeks ago that Turkey would pay a quarter of its Russian natural gas imports in rubles under a new set of trade deals. Indonesia, which is not an SCO member and has yet to buy Russian oil, also mentioned that it would be “open to buying cheap oil from any country”.

It is interesting to see under the current global energy crisis how some countries have performed relative to others versus the dollar. At a high level, it would seem that countries that are self-sufficient in energy and/or are buying some energy in local currency have been outperforming those that are lacking most in energy (consider the Euro, Pound, and Yen as the standout candidates, along with a bunch of Asian currencies – not listed in the table).

Are the EU, UK, and Japan committing economic “seppuku” via their stubborn stance/policy on (Russian) energy imports? Continuing down this narrative, this could remain somewhat of a positive amid a depressing macro environment for China, which is also navigating through its own domestic economic and political issues.

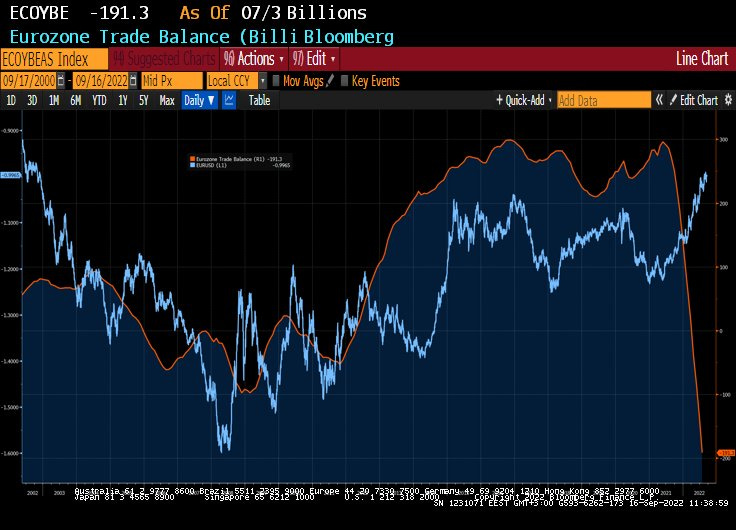

Source: Bloomberg

With the EU and Japan being China’s top competitors in the global export markets, a weak Euro and Yen in theory would benefit European and Japanese goods/exports relative to Chinese ones as traditionally, a country’s trade balance would improve on currency weakness. Unfortunately, we are witnessing both currency and trade balance collapsing for the former owing to rising imported energy costs (supply-side driven as opposed to demand), which is forcing some local businesses and factories to close down. When China does fully re-open its economy (and post-economic crisis), on paper, there will be market share for their taking.

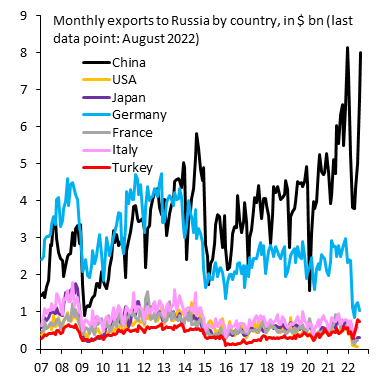

Source: @RobinBrookesIIF

As we write, China’s exports to Russia continue to ramp up at a significant rate relative to the size of the Russian economy. And while the global media continues to perpetuate that Russia is losing its foothold in Ukraine, and that could be the case amid the fog of war, but we take a non-consensus view that Russia won’t be losing the war…so long as President Putin is in charge (he will ensure some sort of win or lose-lose scenario) and more significantly, the Chinese continuing to avoid direct condemnation of the Russians. Both Western and Ukrainian media are running the narrative that Russia is facing chip shortages for its weaponry and other munitions, but trade data would suggest otherwise. Could be the case that China is sending Russia its required components to re-buff its war efforts. China is also quietly stacking the deck in the global tech race (see August post). In any case, almost anything can be re-routed through China. After all, Beijing underpins the global supply chain.

The point from this is dollar strength is likely to dominate in the near term, i.e. into Q422. The world is facing a structural shift in risks. Global currencies and risk asset classes will continue to underperform. We are no longer in an environment where we see inflation well-behaved and central banks can provide easy liquidity to prop up asset prices. Goes without saying things will only worsen should the EU, UK or Japan spiral into a financial or currency crisis.

For now, we continue to build cash, but remain positive on gold (and gold mining), energy and industrials, and look for cheap businesses with strong moats, cash generative properties and have margin of safety.

References:

https://dppa.un.org/en/shanghai-cooperation-organization

https://eurasiantimes.com/out-of-missiles-russia-is-left-with-limited-stock-of-hypersonic-weapons/

2) Israel and China Likely to Sign Free Trade Agreement Late 2022

In early September 2022, the South China Morning Post quoted Israeli consul to Hong Kong Amir Lati, in reporting that China and Israel were likely to finalize a free trade agreement by the end of the year. The deal would be the first of its kind for China in the Middle East. As with almost every other country in the region, trade with China has skyrocketed. Israel’s trade volumes with China stood at USD 250 million 30 years ago and reached USD 22.8 billion in 2021. China is Israel’s most important trade partner in Asia, accounting for 39% of its total export of goods to Asia, according to the Lati.

Israel primarily sells technology to China, particularly in the medical and agricultural fields. This comes at a time when China is increasingly iced out of international technology transfers due to geopolitical tensions, and Chinese officials have repeatedly stated that they wish to emulate Israeli experience in mitigating the impact of drought. In 2021, China officially surpassed the US to become Israel’s greatest source of imports. In an effort to diversify its foreign reserves, Israel added the Chinese Yuan to its central bank reserves for the first time in April 2022, while reducing its holdings of the US dollar and the euro.

The potential free trade agreement comes on the heels of deepening and diversifying cooperation between the two countries. In July 2018, Shanghai International Port Group Co. (600018.SS) opened a USD 1.7 billion container terminal in Haifa under a 25-year build-and-manage agreement. This event sparked controversy in the Israeli media and was raised several times during visits by US officials to Israel. While the port development was significant for Israel, easing bottlenecks and bringing down the cost of imports, its overall importance to Chinese economic ambitions is probably limited. That being said, it was an important “prestige acquisition” in a region where Chinese companies are looking to enter further such arrangements.

Sino-Israeli military ties are surprisingly close, much to Washington’s chagrin. According to a US government report, Israel ranked only second to Russia among China’s foreign arms suppliers. More importantly, these exports tend to be highly sophisticated and battle-tested armaments which China is unable to procure elsewhere. In a show of these military ties, senior PLA commanders have made multiple visits to Israel, and PLA Navy ships have even visited Haifa. This of course sparked the usual chatter that China was planning to build a super-top-secret navy base in Israel, which for now appears to be highly unlikely. Behind the scenes, the US is no doubt protesting, and at the end of the day, the US will remain Israel’s primary guarantor of security for the foreseeable future. While the US may have reservations about the free trade agreement, it does not appear to have exercised its apparent ability to veto major Israeli foreign policy decisions. In the longer term, as US influence in the region wanes (and thereby its ability to act as a guarantor of Israel’s security), Washington’s say in Israeli policy may diminish, as we are already starting to see.

The free trade deal is also likely to facilitate cross-border FDI flows. Chinese companies are already major investors in Israel’s prized high-tech sector, and these flows will likely accelerate due to Chinese companies being locked out of US and EU tech markets. Chinese M&A activity in Israel’s tech sector amounted to roughly USD 9.1 billion up to 2019, according to a report by the US National Institute of Security Studies.

Of course, the Palestine question has been a thorny issue vis-à-vis China’s relationships with other Arab states if it is seen cozying up to Israel. But this too is changing, as many readers are aware Israel normalized relations with several Arab states including the UAE, Sudan, Bahrain, and Morocco under the Trump administration. This list is likely to expand as many Arab governments are losing interest in the various Palestinian factions (due to infighting and a lack of foreseeable resolution to the conflict) and are prioritizing economic ties plus the brownie points they win with Uncle Sam for playing nice with Israel. Besides, China has always been fairly adept at navigating the Israeli-Palestinian conflict, and while it has occasionally expressed condemnation of Israeli wartime excesses, it has been careful not to overtly align with either side.

So, the symbolism of a trade deal between China and Washington’s closest regional ally should not be lost on anyone. China is already making similar overtures to various Gulf States. Our view is that the most likely contender after Israel would be the UAE, given the country’s low barriers to trade and already-significant economic partnership with Beijing. For Israel, the deal is beneficial as Israeli tech companies get more access to Chinese capital, and Beijing gains from further technology transfers and a heightened profile as a major economic player in the region. One thing to look out for in the coming years is M&A activity involving Chinese firms in Israel’s tech sector, particularly in the fields of agri-tech, med-tech, and military hardware, although it is likely that the US would intervene if acquisition targets are deemed to be too sensitive…

References:

https://www.china-briefing.com/news/china-israel-investments-trade-outlook-belt-and-road-initiative/

http://en.people.cn/90786/7909896.html

https://www.tabletmag.com/sections/israel-middle-east/articles/chinese-itzik-haifa

3) Turkey’s Middle Corridor and Compatibility With Belt and Road Initiative

On 26 September 2022, the bilateral China-Turkey Communication Forum hosted representatives from the two countries to discuss political, economic, and cultural cooperation. The meeting came shortly after a meeting between presidents Xi Jinping and Recep Tayyip Erdogan in Uzbekistan, in which both sides agreed to elevate bilateral ties. The meeting addressed synergies between China’s Belt and Road Initiative (“BRI”) and Turkey’s Middle Corridor (“MC”) proposal. The MC is a planned transportation network connecting Europe and Asia, and shares many conceptual similarities with the BRI (which Ankara signed up for in 2015). In November 2019, the first cross-Caspian China-Europe freight train via Turkey arrived in Prague, Czech Republic, although transshipments remain small. These developments come off the back of greatly enhanced Sino-Turkish economic ties, the dynamics of which have developed beyond the usual supplier-customer dynamic characterizing much of China’s trade with the developing world.

In 2000, bilateral trade stood at USD 1 billion, a figure which jumped to USD 32 billion in 2021, largely consisting of Chinese tech and textiles exports. China is now the largest destination for Turkish exports (approximately USD 2.9 billion), mostly consisting of processed construction materials. FDI has escalated significantly, there are now more than 1,200 Chinese companies operating in Turkey with a total investments valued at approximately USD 4 billion. This is also reflected in public sector-led projects, and Turkey has received about 1.3% of BRI investments, ranking 23rd among the other BRI countries.

While this article will focus more on the overall geopolitical dynamics underpinning these developments, we can highlight some of the challenges facing the MC at present. Various media commentary has highlighted that the MC traverses a somewhat complex route necessitating multiple modes of transport due to the Caspian and Black seas. At present, there is a glaring lack of customs and tariff alignment between the countries along the MC route, although recently there have been promising statements from the likes of Turkey, Azerbaijan, Georgia, and Kazakhstan to address some of these issues.

Source: Turkish Ministry of Foreign Affairs (detailing Caspian portion of a wider project that will link the country with Urumqi in Xinjiang, PRC)

These developments are yet another sign of the developing world diversifying its ties away from the West. Turkey, a NATO member and traditionally a US ally, has had significant spats with the EU and the US on issues such as the refugee crisis, Syria, Iraq, and Israel, among other high-profile disputes. Turkey is now emphasizing political and infrastructural connections with Asia, with these having been traditionally oriented towards Europe. In addition to China, Turkey has also pivoted towards Russia (although this relationship has also had its rough patches), for example by signing a deal to purchase the SD-400 air defense system which was met with retaliatory sanctions from Washington and threats over its NATO membership. The challenges created by the war in Ukraine and growing Sino-US tensions have engendered a sense of urgency around diversifying supply chains, and it does not appear that the West is overtly hostile to the MC, given that Turkey remains somewhat amenable to the West. Hence, Ankara is likely to court the west, China, and Russia in a delicate balancing act allowing them to maximize returns as an important regional power and strategically located country.

The wider Russia-China dynamic is also notable in regards to the MC, as the corridor will pass through areas considered to be within Moscow’s sphere of influence. While many observers often paint Russia and China as a monolith, the two are by no means acting in tandem in Central Asia, where Moscow views Beijing’s growing economic clout with suspicion. The war in Ukraine appears to have significantly harmed Russia’s political and economic influence in the region, with even long-time allies like Kazakhstan becoming critical of the war. While Beijing will likely seek to maintain warm ties with Moscow, it may also seek to capitalize on Moscow’s harmed prestige in this prized geography. At the end of the day, Turkey will benefit from increased Sino-Russian competition in the region as both countries attempt to “win-over” Ankara to their various regional agendas.

References:

https://www.china-briefing.com/news/china-turkey-bilateral-trade-and-investment-profile/

https://www.heritage.org/trade/commentary/the-west-should-welcome-the-middle-corridor

https://eurasianet.org/kazakhstan-hits-back-at-russia-over-ukraine-ambassador-row