Panca Budi Idaman (PBID.JK) – Bagging deep value in Indonesia’s plastic surge

Recycling Rupiah into a deep value packing leader with competitive margins and rising dividends

Indonesia’s plastic packaging industry may not be shiniest, most headline-grabbing EM play, but this Company is among the leanest in the business, with a grip on traditional markets that multinationals will struggle to match. PT Panca Budi Idaman Tbk (PBID.JK; “Panca Budi”) generates high returns on minimal leverage, compounding quietly while others chase growth at any cost. With rising dividend payouts, near-zero net debt, and a moat built on distribution and consistency, this name is an overlooked yield play in Southeast Asia’s largest consumer market.

Our first successful foray into Indonesia was state-owned miner PT Aneka Tambang Tbk (ANTM.JK, ATM.AX; “ANTAM”), covered in our 2023 deep dive with an update in July 2025 (~83% total return).

ANTAM’s growth story remains intact and valuations undemanding, but we have since trimmed the position with an eye on other opportunities to park some of our Rupiah loot.

The Indonesian plastics player covered in the piece is another byproduct of Altraman’s recent work in this space. Last month’s Shandong trip report, where we highlighted a discounted Chinese wood panel manufacturer poised for regulatory upside in a sector marred by overcapacity.

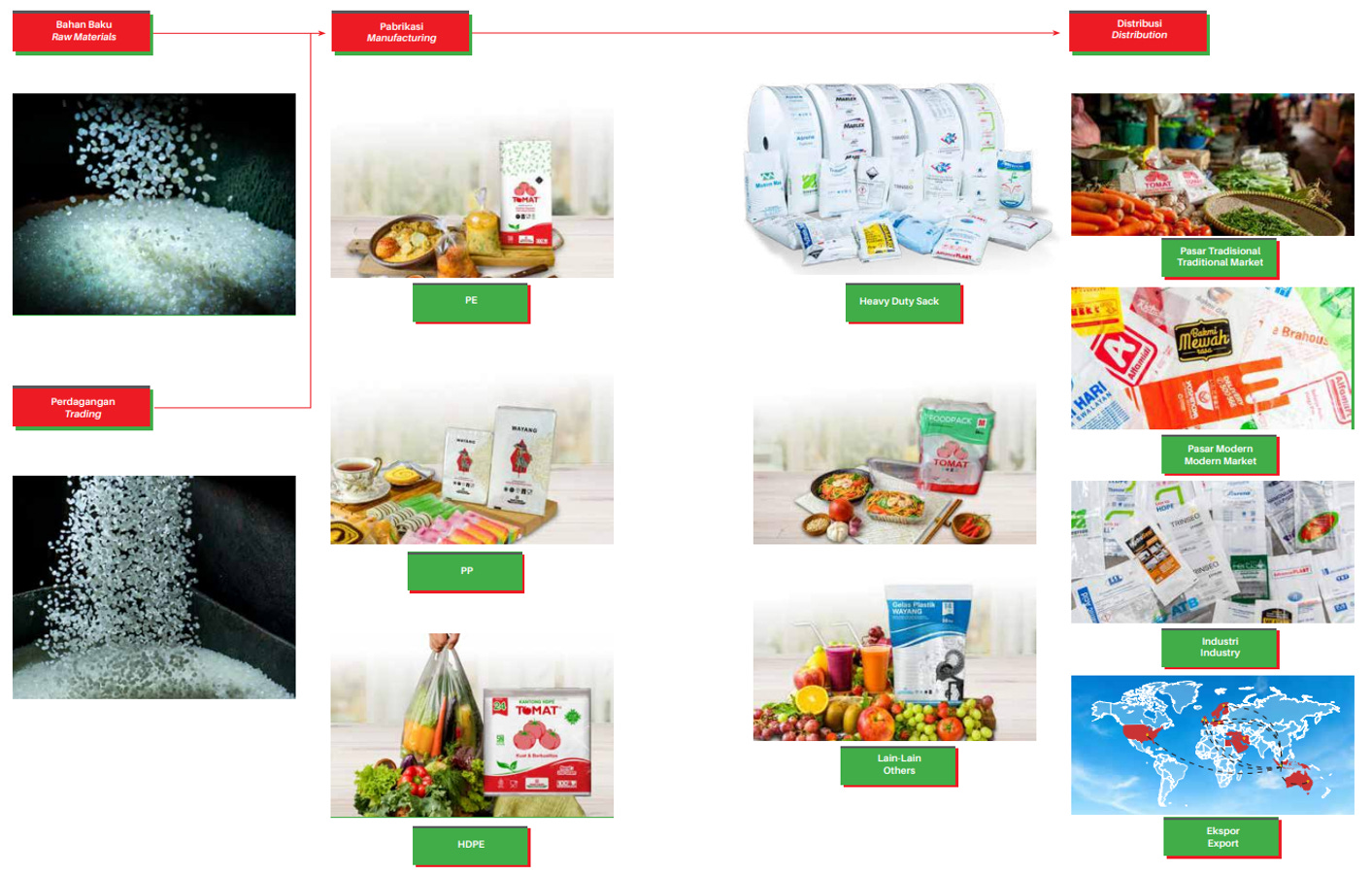

Local resin trader turned packaging titan

Founded in 1979 by a humble resin trader, Djonny Taslim, Panca Budi is an integrated manufacturer and distributor of plastic packaging and resins that has evolved into Indonesia’s integrated plastic packaging leader, listing on the IDX in 2017 with a current market cap of ~ USD 220 million. It manufactures and distributes products like food-grade bags, heavy-duty sacks, and resins, serving everyone from street vendors to multinationals such as Coca-Cola (KO.N).

With 12 factories and 6 warehouses across Indonesia and Malaysia, boasting 157,000 tons of annual capacity and a workforce of over 5,600, Panca Budi holds niche leadership in consumer packaging. Plastic packaging drives 67% of revenue, with the other 27% and 6% coming from resins and other products, respectively. Domestic focus (85% of sales) insulates from export volatility, with export markets including the UK, Germany, the Netherlands, Spain, UAE, Nigeria, USA, and Taiwan.

Indonesia plastic paradox: Growth and catch-up potential amid green gripes

Indonesia’s plastic packaging industry, valued at USD 10.47 billion in 2025, is expected to grow at a 6.7% CAGR to USD 14.45 billion by 2030. The landscape is fragmented, with thousands of small players and no single firm dominating more than a small fraction of the market. Reliable data is scarce in this space, but based on public sources and historical reports, Panca Budi is a leading local player among mid-tier firms, though it trails multinationals.

At the subsegment level, data from 2018 indicates that Panca Budi held a ~32% share of the plastic consumer packaging market, including nearly half (47%) of the market in the Greater Jakarta region. While access to new data has been limited, we suspect the Company has either maintained or grown its market share further given trajectory of its revenues and earnings.

The sector stands as a bellwether of progress and peril, where urbanization and consumer booms collide with environmental imperatives in Southeast Asia’s largest economy. Dominated by packaging, resins, and end-products for wholesale and retail trade and heavy industries (~40% of GDP), surging demand juxtaposes evolving regulations curbing pollution.

Indonesia’s per capita plastic consumption has risen from 17kg in 2018 to ~29kg in 2024, reflecting brisk business for packaged goods and e-commerce. However, the average per capita plastic consumption across ASEAN, Japan, and South Korea sits at ~67kg, highlighting ample headroom for growth and convergence as incomes rise.

If Indonesia continues on its development trajectory (and recycling policies emulate those of regional peers), consumption is likely to approach levels seen in Malaysia and Thailand (38kg and 45kg per capita, respectively).

Even without aggressive anti-plastic policies, economies with stricter regulations exhibit higher plastic consumption, with Singapore leading the region by this metric. Policies often target leakage from plastic recycling chains, e.g. banning single use plastics (SUPs), rather than demand suppression. Consumption has continued to grow in Singapore, Malaysia, and Thailand despite SUP and plastic import bans, largely off the back of robust FMCG and e-commerce activity.

Indonesia’s plastic policies emphasize reduction of SUP use, reuse, and circularity through a mix of national roadmaps, phased bans, and producer accountability. The approach favors incentives and education over penalties, with measures targeting import restrictions, mandatory recycling funding, and content standards. Local initiatives complement national goals, aiming for substantial waste cuts and increased use of recycled materials by the end of the decade.

These ambitious milestones position adaptive players well. For Panca Budi, alignment comes via recycling (subsidiary Politek Grin Packindo produced 11,040 tons of rPE/rPP in 2024, ~7% of output), appealing to eco-conscious clients. Stricter enforcement supports Panca Budi’s integrated model, helping it manage costs and market shifts more effectively. Domestic focus (85%) insulates the Company from import bans elsewhere, accelerating growth in underserved East Indonesia.