Musings to multi-baggers and mercifully few lemons: A review of all our picks to date

An unfiltered lookback on three years of emerging market investment write-ups – hits, misses and why each piece mattered

Three years ago, we set out not to chase alpha, but to cultivate it – patiently, deliberately, and often off the beaten path. What began as an experiment in emerging market storytelling has since evolved into a healthy collection of 53 write-ups and 8 podcast episodes. Each reflects the rhythm of our research rather than the pressures of content cycles.

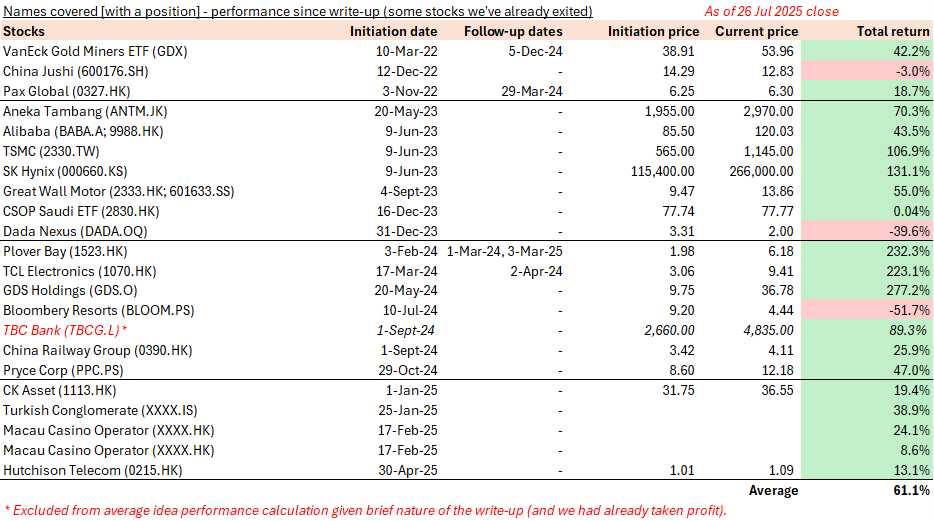

Today, we mark our third anniversary with a performance snapshot: an honest accounting of what’s worked, what surprised us, and what continues to shape our thinking.

A sincere thank you to our supporters – many of whom we are fortunate to call friends, colleagues, and fellow travelers on this journey. While content production has taken a dip due to personal and professional reasons in the past few months, we remain committed to pushing out a high-quality content every 4-8 weeks.

Our subscription pricing is deliberately set at the low end of the spectrum to avoid the pressure of churning out content for content’s sake. The pyramids weren’t build in a day, and neither are our best ideas – but we are still laying bricks.

That said, we are proud of the evolution of our content over the past three years, including our track record of organic idea generation and finding emerging market opportunities. The goal isn’t to flood inboxes but to ensure each piece counts – whether that’s through interviews with business leaders and investors, ideation from travels, macro musings, or by putting our own capital to work based on these insights.

A mix of eclectic trades, long-shot bets, and the occasional multi-bagger (with mercifully few lemons) has made the journey worthwhile.

Performance doesn’t always reveal itself quarter by quarter – it unfolds over time, in subtle signals and stubborn convictions. As we step back and examine the numbers, we aim not just to tally returns, but to understand what they reflect about our processes. What surprised us most? That some of our “least consensus” names outperformed despite initial discomfort. What challenged us most? Knowing when to trim winners and reallocate – especially in thin liquidity pockets. Each lesson has quietly reshaped how we evaluate opportunity cost.

If our cadence resonates, subscribe for future insights. If you’re new, scroll through the archives. The story’s best told in chapters.

VaNeck Gold Miners ETF (GDX)

Reference articles:

Since our initial analysis in March 2022, VaNeck Gold Miners ETF (GDX; “GDX”) has delivered a 42% total return, with much of the rally driven by a confluence of macroeconomic, geopolitical, and structural factors – particularly the resurgence of gold as a preferred hedge against global instability. Before 2022, GDX had lagged behind physical gold, but the ETF has since closed this gap, benefiting from strong ETF inflows as investors sought liquid exposure to gold and improved sentiment as mining stocks realigned with soaring bullion prices.

Record gold prices fueling miner profits

Gold has soared to all-time highs in 2025 (>USD 3,300/oz as of today), providing a powerful tailwind for gold mining companies. Unlike physical gold, miners offer operational leverage, meaning their earnings expand disproportionately as gold prices increase, given relatively fixed production costs.

Cocktail of geopolitics, central bank buying sprees, and dollar weakness

EM central banks diversifying: Emerging market central banks have been aggressively diversifying away from US treasuries since the start of the Russia-Ukraine conflict. Western powers’ weaponization of the Dollar and the seizure of Russian assets abroad had an unintended consequence: it signaled to the world that FX reserves abroad are not immune to geopolitical risks. This realization, among other factors, has driven central banks to accumulate gold at record levels. The Federal Reserve’s pause on rate hikes in late 2024 coupled with a softening the Dollar have further bolstered gold’s attractiveness.

Weakening confidence among the world’s central bankers in US fiscal stability

A recent UBS survey of global central bankers highlighted a growing unease with traditional reserve assets and monetary policy stability. Key findings include:

Half believed a US debt restructuring is inevitable.

Two-thirds expressed concerns over the Fed’s independence amid politicized fiscal policies.

Nearly half question the reliability of US economic data, signaling eroding confidence.

While 80% still view the dollar as the dominant reserve currency, many view gold as the top-performing asset through 2030.

This shift has prompted institutions to increase allocations to gold as well as emerging market assets, as hedges against stagflation and geopolitical risk.

For now, we think GDX continues to stand out as a high conviction vehicle on sustained gold demand – driven by monetary uncertainty, de-dollarization trends, and persistent global instability.

We hold shares in VanEck Gold Miners ETF (GDX).

China Jushi (600176.SH)

Reference article:

China Jushi (600176.SH; “Jushi”) was one of our earliest investments driven by an emerging markets lens, inspired by our on-the-ground experience in Egypt. While the thesis – a vertically integrated Chinese fiberglass leader with global scale (20-25% market share) and cost advantages – remains valid, thus far, the stock has returned a disappointing -3% total return since our initial write-up.

Where our thesis stumbled was around the unexpected challenge of Egypt's currency crisis. The EGP's sharp depreciation significantly eroded revenue from Jushi’s local factory, despite its strategic importance for tariff hedging and renewable energy infrastructure. We maintain conviction in Egypt's long-term infrastructure demand but acknowledge that margin compression (from rising costs), China's property sector downturn, and global fiberglass oversupply have outweighed the Company's advantages in high-end product specialization in the near term.

We are seeing some encouraging signposts this year that may signal an inflection point. Jushi has successfully implemented 15-23% yoy price increases on key products like wind blade fibers, coinciding with China's 19% yoy growth in wind capacity – a combination that should drive margin recovery. Furthermore, Egypt’s currency crisis has eased and GDP growth is on the up and clipping along at 4.3%.

Simultaneously, the AI-driven boom in data centers is pushing up demand for some of Jushi’s products. We see room for potential re-rating should price hikes stick and its offshore (including Egypt and the US) facilities provide a geopolitical hedge and revenue diversification. The stock trades at a forward blended P/E and EV/EBITDA of 14.5x and 9.8x respectively, with a dividend yield of 3%.

We hold shares in China Jushi (600176 SH).

Pax Global (0327.HK)

Reference articles:

Pax Global (0327.HK), a leading electronic payment terminal provider, has delivered a 19% total return since our initial write-up, with the bulk coming from dividends and the recent share price recovery. The Company faced significant challenges over the past two years, with revenue declining 25% and net profit plunging 44% over the 2022–2024 period. This downturn was driven by softening global demand for payment terminals, particularly in Europe and the US (51% of sales), and market maturation in LATAM (31% of sales). The stock hit 52-week lows of HKD 3.97 in August 2024 (briefly trading at a 12% yield) but has rebounded notably since April 2025. This recovery appears likely to be driven by:

Cautious optimism ahead of H125 earnings: We don’t think there are any major upside surprises to be expected in the near term other than revenue stabilization, margin improvements and continued corporate activity.

July 2025 leadership changes: The Chairman assumed the dual CEO/Chairman role after the incumbent CEO’s resignation earlier this month, reducing executive compensation costs by USD 3.1 million. Notably, the four top executives (including the outgoing CEO) collectively cost USD 7.37 million in 2024 (8% of net profit).

Perhaps more to trickle through to shareholders? Let’s see…The stock trades at a forward blended P/E and EV/EBITDA of 8.2x and 3.5x respectively, with dividend yield of 8% (assuming last year’s dividend is maintained).

We hold shares in Pax Global (0327.HK).

Aneka Tambang (ANTM.JK)

Reference article:

Our deep dive and investment in PT Aneka Tambang Tbk (ANTM.JK, ATM.AX; “ANTAM”) marked our first – and certainly not last – foray into Indonesia. While our initial timing proved a bit premature, with 2023 results falling short of expectations, we recognized this as a multi-year story from the outset. The Company's diversified operations and hidden optionality provided conviction to weather short-term volatility, including the opening of a large nickel matte facility Pomalaa, among other value-added projects.

ANTM's dramatic turnaround gained momentum through 2024, culminating in record revenues of USD 4.22 billion (+69% yoy), powered by two key drivers:

Gold's breakout performance, leveraging both safe-haven demand (>USD 3,300/oz) and distribution through its digital platform.

Strategic cost restructuring that transformed the balance sheet to a net cash position in H224.

This operational momentum accelerated into this year, with Q125 revenue surging 203% yoy to USD 1.6 billion and net income multiplying tenfold to USD 142 million. Preliminary Q225 data suggests another record quarter, potentially supporting enhanced shareholder returns.

While our original nickel-centric thesis remains valid – evidenced by record production and progress in EV partnerships (notably with Contemporary Amperex Technology (300750.SZ; “CATL”)) – gold has unexpectedly emerged as the dominant profit driver (83% of Q125 sales). The market has increasingly priced ANTAM as a gold proxy, though its nickel optionality retains significant value. With substantial reserves and government alignment, ANTAM is strategically positioned to expand its EV value chain partnerships. The Company plans to secure additional funding for its CATL joint venture, targeting projects that could add 10 million tons of nickel ore sales volume by 2027 through downstream development. The stock trades at a forward blended P/E and EV/EBITDA of 11.3x and 7.2x respectively, with dividend yield of 5%

We hold shares in PT Aneka Tambang Tbk (ANTM.JK).

Alibaba (BABA.A, 9988.HK), TSMC (2330.TW) and SK Hynix (000660.KS)

Reference article:

When NVIDIA Corporation’s (NVDA.O, “NVIDIA”) AI boom ignited market euphoria, our back-to-basics approach targeted key suppliers trading at cyclical lows has paid off.