Plover Bay Technologies (1523.HK) – A milestone year with strong growth and expanding opportunities

Laying the foundation for sustainable growth and rewarding patience along the way

Plover Bay Technologies (1523.HK, “Plover Bay”) with a market cap of approximately USD 739 million, experienced another stellar year with its FY24A annual results, showcasing a notable 24% revenue increase, exceeding the USD 100 million threshold (also known as the “valley of death”) to reach USD 117 million, while also realizing a 36% YoY growth in net profit, amounting to USD 38 million. This success is complemented by strategic partnerships, and ongoing innovation. With deepening collaborations, an expanding product line-up, and an emphasis on recurring revenues, Plover Bay is well-positioned for sustained growth in 2025 and beyond.

Plover Bay manufactures routers and sells subscriptions for always-on 5G connectivity, accessible from anywhere in the world. Put simply, the Company leverages satellites to deliver internet to far flung corners of the earth or for one-off use cases. For example, mines in the desert, research bases in Antarctica, or disaster zones, and increasingly for planes, trains, and ships.

In this piece, we cover Plover Bay’s FY24A results and earnings calls (announced 27 Feb 2025) as a follow up to our coverage of the Company last year, when we met and interviewed its Founder Alex Chan:

and detailed their FY23A results:

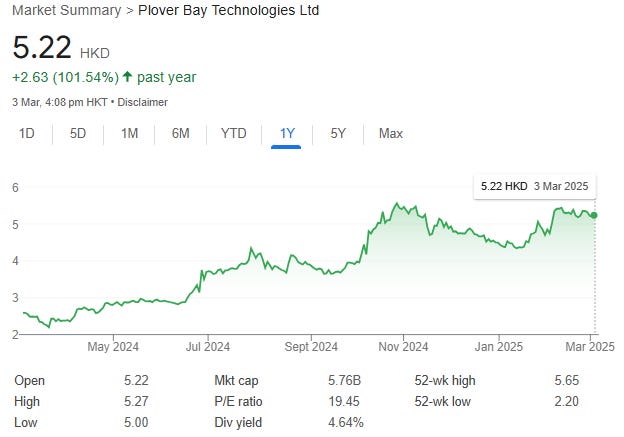

As of today, the stock is up over 100% since we started writing about the business and remains undemanding at a forward P/E of 15x with anticipated earnings trajectory of low-twenties-high-teens over the next couple of years. Shares had a nice run-up into the result, but have remained about flat since then.

Robust growth on a solid foundation lays the groundwork for more to come

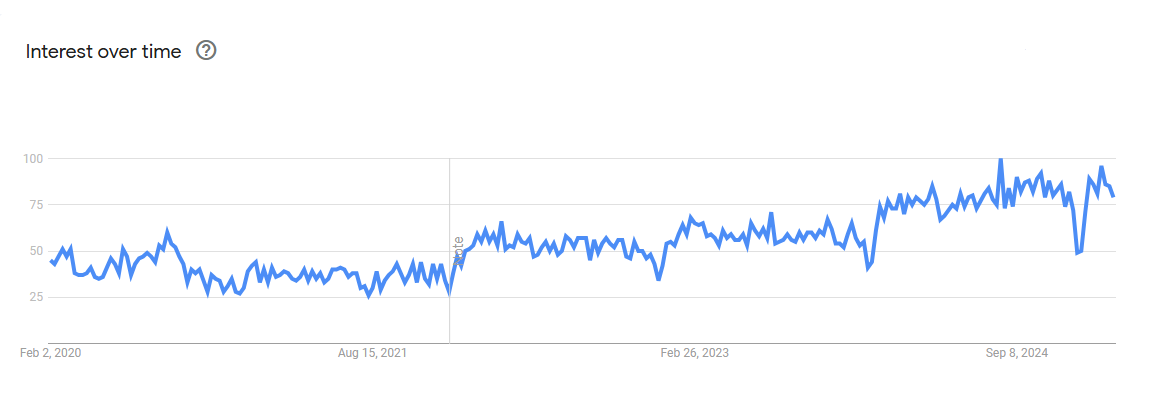

Early-on in the call, management hinted at positive momentum for the first two months of 2025, reinforcing expectations for continued organic growth. The trajectory also aligns well with product interest trends for Peplink. Our good friend @ArenaManCapital creatively noted an almost 1-to-1 correlation between Plover Bay’s revenue versus a smoothed simple moving average for Google search interest in the Company, providing a helpful indicator on the Company's performance.

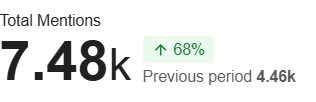

A quick search of media and public social media mentions of Peplink also shows 68% growth YoY.

The Company achieved record overall revenues and profit, with strong growth in recurring revenues from subscription-based software licenses (up 12.4% YoY) and warranty and support services (up 6.4% YoY). These segments now make up 29% of the business. The subscription take-up rate increased to 34% from 31% last year. Management aims to grow recurring revenue to around 35%. Recurring revenue, partly deferred due to hardware sales growth from the previous year, showed modest growth in FY24A, reflecting FY23A’s equipment growth. A stronger pick-up is expected this year, driven by a 30% YoY increase in 2024 equipment sales.

Reflecting confidence in its financial health and trajectory, Plover Bay declared a second-interim dividend of HKD 13.37 cents, along with a special dividend of HKD 5.65 cents to reward shareholders. In the first half of the year, the Company had already distributed a dividend of HKD 10.83 cents, resulting in a full year dividend payout of 111%. At current price levels, the stock is indicating ~6% dividend yield on a forward basis assuming continued earnings growth trajectory and a base payout of 90%.

Strategic partnerships drive expansion

One of the most significant drivers of Plover Bay's growth has been its cooperation with Starlink, which has strengthened through new enterprise-focused solutions.

According to management, the Company has been expanding its channel partner network, now exceeding 400 partners, to deepen its presence in markets such as transportation (aircraft, trains, vessels), mining, and construction. These partnerships will continue to enable seamless mobile connectivity in remote and challenging environments.

Additionally, the Better Together program with T-Mobile allows the bundling of 5G plans with Peplink routers, further enhancing adoption and providing customers with integrated solutions.

Product innovations continue to set Plover Bay apart from competitors

The Company continues to diversify its product offerings to align with evolving market needs:

Starlink-compatible solutions: A growing range of products integrate with the Starlink ecosystem, making low-earth orbit (“LEO”) satellite deployments simpler and more accessible. Management commented that there is robust demand for these solutions, particularly in maritime and remote enterprise applications.

Switches and data plan business: The December launch of switches has yet to generate significant revenue, though enhancements based on channel partner feedback are underway.

SpeedFusion: Embedding data plans in devices is gaining traction as a scalable and recurring revenue model.

Antenna business growth: After a slow start in 2019, the Company’s antenna business is now seeing steady expansion.

Edge computing: Offering simplified deployment for IoT and managed service providers. With global IoT connections growing at a 16% CAGR, this represents a significant opportunity. Management specified that capabilities are still early-stage but could significantly differentiate Plover Bay in the future.

Competitiveness and supply chain help the Company navigate geopolitical risks

Unlike competitors that either lack certification across multiple regions or do not focus on Plover Bay’s niche connectivity solutions, the Company continues to dominate in specialized verticals.

Due to this unique positioning, Plover Bay has some impressive flagship deployments. For example, the Royal Caribbean (RCL.N) cruise line uses the Company’s devices across its entire fleet. The US government has approved Plover Bay’s routers for airlines, providing a significant growth runway (pardon the pun). Another notable deployment was on fire services vehicles during the 2024 LA fires, building good press around the Company as a reliable partner for the US public sector.

Indeed, many may wonder if the Company suffers from the negative connotations of being a China-based tech company. Unsurprisingly, concerns over US tariffs were raised in the earnings call, but management clarified that the Company remains largely unaffected due to its Taiwan-based supply chain and efficient operational model.

One area where Plover Bay may be underselling its potential is in the developing world. Much like how some countries skipped landlines for mobiles, and more are leapfrogging traditional power grids to distributed solar, internet connectivity is another area where such leapfrogging could occur.

A joint Peplink-Starlink solution installed for telcos in Africa has replaced costly fiber links and satellite earth stations, achieving speeds of 200-350 Mbps while significantly reducing operational costs. We believe such trends are likely to provide significant tailwinds for the Company in the medium to long term. This also provides a hedge against US tariffs targeting Taiwan, but so far these are only being discussed for chip exports.

Another overlooked aspect that was noted, but not thoroughly addressed during the call is the opportunity to engage with the broader consumer (retail) market. Although Plover Bay’s applications are primarily B2B-focused, there is significant potential to access and penetrate this market with their high-quality technology products. This is an area the team is actively exploring and in the pipeline in the coming years.

Looking ahead, the sky is the limit

With strong financials, expanding partnerships, and a focus on innovation, Plover Bay remains optimistic about 2025. The Company prioritizes product competitiveness and R&D investment over short-term financial engineering, emphasizing organic growth rather than artificial revenue inflation. Plover Bay sits on a solid net cash position of ~8% of its market cap – the Founder remains very open to M&A opportunities, but as noted in our interview with him last year:

Our mindset around M&A is evolution from organic growth to view connectivity-as-a-service holistically. As opposed to acquiring distributors or other networking firms of similar sizes, I prefer seeking out partnerships or acquisitions demanding reliable connectivity to continue building and strengthening our customer base.

Even small opportunities can be interesting to us, due to our experience integrating remote teams globally. Financial risk is low as deals would be pursued for synergistic value creation rather than because there is private equity backing forcing the Company to do it. When evaluating M&A, I prioritize cultural compatibility and strategic fit on top of financial metrics. Deals enhancing Plover Bay's solution scope in new industries or markets are most appealing.

Shareholder value ultimately remains the priority. In the same light, the Board and I will always entertain attractive overtures that fully recognize Plover Bay's intrinsic worth – these are assessed objectively on how they serve shareholder interests. However, the priority remains scaling operations through continual reinvestment in technology and staff. Simply accepting premium bids that undervalue long-term potential or disrupt our strategic roadmap would not be sufficient.

For a Hong Kong-listed company, Plover Bay remains a star-performer among the pack, in what has been a depressing and lackluster market. The shares are not as cheap as it once used to be, particularly from a valuation perspective. With a majority of its business (64% of revenues) and growth (38% YoY) coming from the US, to us, we think it could be advantageous to do a secondary listing in the US to enhance liquidity, tap into a different shareholder base, as well as increase overall visibility for the business. Of course, that said, we do not have any foresight of whether management plans to do this, but reckon if they did proceed with this, it probably would be very well received, contrary to more mature names attempting the same.

In any case, Plover Bay’s ability to deliver repeatable, scalable results makes it a standout player in the evolving connectivity space. Many will be watching closely as the Company continues to shape the future of seamless mobile networking.

Full disclosure: We hold shares in Plover Bay Technologies (1523.HK).

Disclaimer: This research piece above is for informational, entertainment, educational, and/or study or research purposes only. The information contained herein or discussed does not, should not, and cannot be construed as or relied upon and, for all intents and purposes, does not constitute or provide professional financial, investment, or any other form of advice. This research does not and should not be construed as an offer to sell or the solicitation of an offer to buy any securities or any other financial instruments in any jurisdiction, including where such actions are illegal. This research is not intended for publication in jurisdictions where it would violate laws. The research does not consider individual investment objectives or financial positions and merely expresses the opinions of its authors. Any investment involves taking substantial risks, including (but not limited to) the complete loss of capital. Every investor has different strategies, risk tolerances, and time frames. You are advised to perform your own independent checks, research, or study, and you should consult a licensed professional before making any investment decisions. The assumptions and parameters discussed or used are not the only reasonable ones, and no guarantee is given for their accuracy, completeness, or reasonableness. No promise is made that any indicative performance return will be achieved. The research is derived from public information sourced by Pyramids and Pagodas. No representation or warranty is given for the reliability, completeness, timeliness, accuracy, or fitness of this research, nor is any responsibility or liability accepted for any loss or damage. The authors (Pyramids and Pagodas) shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Ah Plover Bay, the gift that keeps on giving, the owner operated quality business that was selling at such a discount last year thanks to the HK stock rout. I'll never make a better investment. The need for reliable internet on transport and remote locations still has 5-10 years of runway since everything is in the cloud these days