Russia Trip Report – Economic insights and other titbits (Part 1)

Notes on the current state of play for air travel in Russia and China on my journey to Moscow

Late July/Early August, Altraman spent two weeks in Moscow, the capital of Russia.

We will be releasing a four-part Series covering Altraman’s recent trip to Moscow from Hong Kong, during which he uncovered many ground truths about the economic situation there, as well as insights into the workarounds being used to keep businesses open and money flowing amidst increasingly hostile sanctions. Few aspects of life in Russia appear untouched by the current geopolitical climate, which was evident even during Altraman’s journey to the country. Hence the first piece in this series will focus on the logistics of travel to Russia from Asia and a quick look into the health of air travel markets in Russia and China.

Travelling from Hong Kong to Moscow's Sheremetyevo International Airport before the pandemic and the Ukraine war used to be very affordable with direct return flights for less than USD 600.

Unsurprisingly, Chinese airlines continue to operate to Russia. These carriers are also allowed to fly over Russia on flights to Europe and the US, unlike their international competitors who have cried foul over this supposedly unfair advantage. In fact, Washington has only just permitted Chinese carriers to increase flights to the US on the condition that they do not fly over Russia.

These days, there are no direct flights from Hong Kong to Moscow. Any round-trip flight under USD 750 (HKD 5,856) will have ridiculous layovers in China. Price discovery is a bit more of a challenge with big travel websites (CheapFlights, Expedia, Skyscanner) no longer providing flights to Russia. Hong Kong or China-based websites such as Hutchgo or Trip.com can be used as alternatives.

I looked further inland and found plenty of affordable options from the likes of Hainan Airlines (900945.SS), China Southern Airlines (1055.HK), and Sichuan Airlines below from Shenzhen stopping in Beijing at around USD 500 (CNY 3,592).

As a Hong Kong Passport and “Home Return Permit” (港澳居民来往内地通行证) holder, I did not require an entry visa into either China or Russia. It's noteworthy that China does offer 24- and 72-hour visa-free transit for foreign citizens travelling to a third country or region through China by plane, ship, or train. Even if one needed a visa, both getting one and the cost of traveling to a Chinese domestic airport from Hong Kong, combined with a round trip flight ticket could still be done for less than USD 600-700.

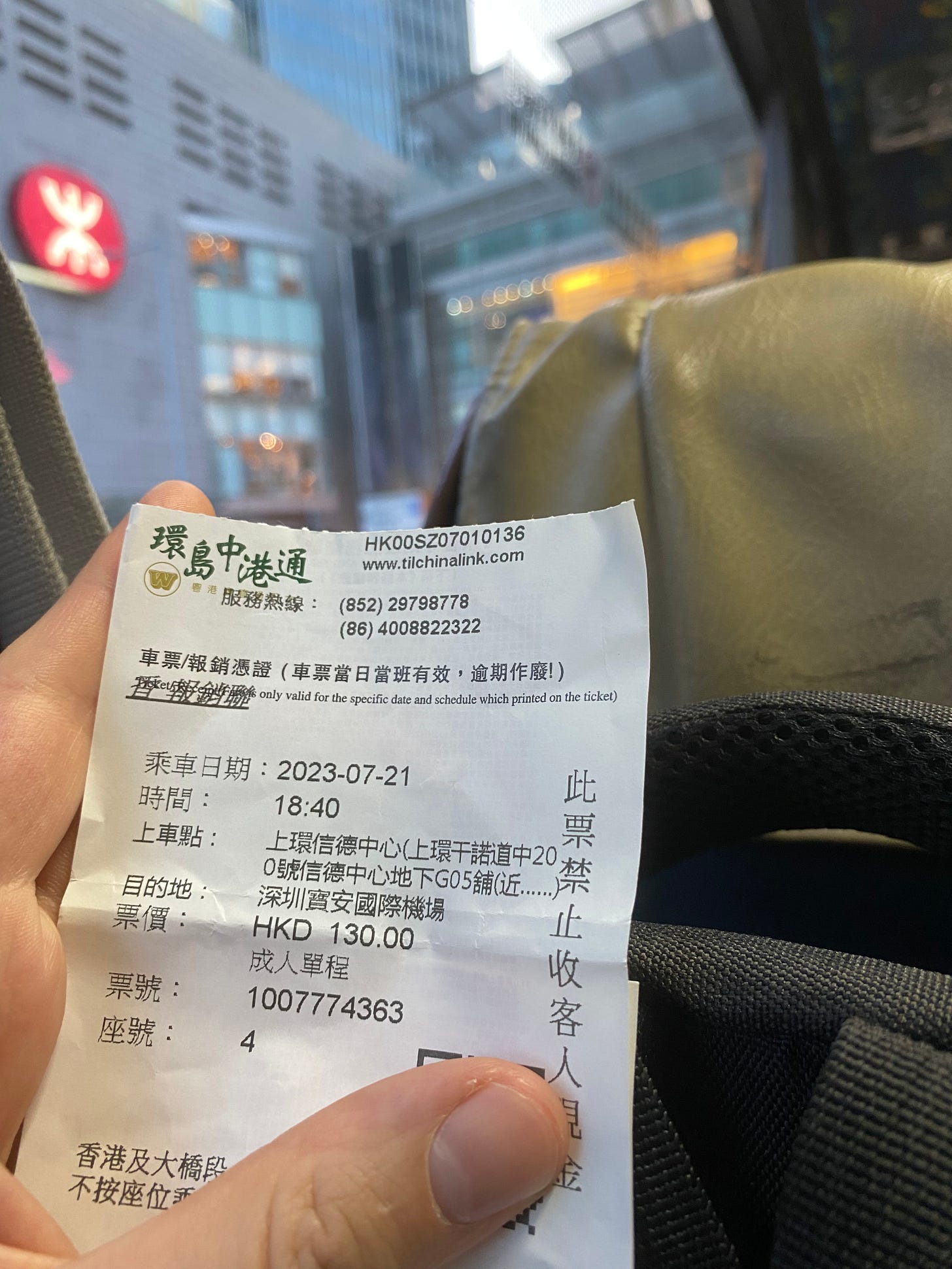

I took the coach from Hong Kong to Shenzhen International Airport for USD 17 (HKD 130), which was about a 2-hour journey end-to-end including border-crossing.

The state of international aviation in China – a look at Beijing and Shenzhen airports

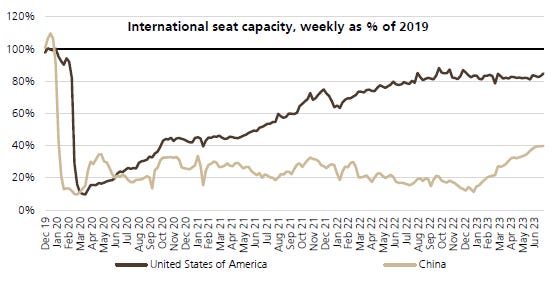

When you spend most of the year glued to the desk trawling through economic and financial data, you gain a new appreciation for seeing these data points come to life during travel. During my layovers in China, specifically Shenzhen International Airport (000089.SZ) and Beijing (Capital) International Airport (“Beijing Airport”, 0694.HK), the bulk of the passenger flow was domestically driven, while international traffic remained muted. Beijing Airport operates both the Capital International Airport and the newly-opened Daxing International Airport. This is quite consistent with the slower Chinese recovery story that we have seen come through data as per below. In addition, I noticed that many stores and F&B outlets remained closed at Beijing Capital International Airport (“PEK”).

Sell-side consensus is forecasting Beijing Airport to pull around CNY 6.1 billion in revenues and achieve breakeven or a slight net loss for FY23e. Anecdotally, it feels that the FY23e loss reversal expectations on the stock seem rather optimistic. Beijing Airport’s 5-year stock performance has been disappointing owing largely to COVID-19. Costs also blew over in 2022 on security operations for the Beijing Winter Olympics and maintenance and repairs. The market has been wrong several times on the Company’s growth and recovery, which has also hurt sentiment towards the stock. Beijing Airport posted CNY 844.6 million revenue and a (CNY 352.3 million) loss in Q123. Their interim report is expected to be announced end of August. I could be wrong, but passing through PEK didn’t give me particular confidence that we will see any significant upside surprises in Q223 just yet.

Any turnaround story for Beijing Airport would require more international traffic, which is generally more lucrative for airport operators than domestic. The additional passenger flow would lead to a significant boost in their non-aeronautical revenues (i.e., advertisements, F&B outlets and retailing etc.). However, a slow recovery for international travel in China, given geopolitical and economic headwinds, makes this unlikely in the short to medium term.

Monthly airline data out of China shows that international capacity still stands at a lowly ~40% of 2019 levels. Beijing Airport stock is interesting given it has fallen to around 2014 levels, where it traded at forward EV/Sales, EV/EBITDA, and P/E of around 5x, 8x and 13x respectively. Back then, the Company only operated Beijing Capital International Airport, but was growing it successfully and profitably. We use these metrics as reference benchmarks to assess a potential entry. For now, we see the earnings recovery story looking likely to be pushed back to FY24e or FY25e and think the stock can be even cheaper than currently. Won’t be surprised to see shares folding further under HKD 4.00…we’ll be keeping a watchful eye on any potential breakout from market speculation (contrary to our beliefs).

The stock of Shenzhen airport has fared slightly better year-to-date (-12%) relative to Beijing Airport (-27%) and Shanghai International Airport (600009.SS) (-31%). Shenzhen Airport did experience a substantial increase in aircraft movements and passenger throughput. Aircraft movements increased by 68.5%, while passenger throughput increased by 159% in Q123. Domestic passenger throughput showed strong growth, and regional and international passenger throughput also exhibited signs of recovery. A comparison of flight volumes out of Shenzhen versus Daxing and Beijing Capital combined saw an increase of 74% yoy for the former and 54% yoy for the latter in Q123.

We think it could be a good trading opportunity over the next 6-12 months. Certainly, don’t see it being anywhere as impressive as our calls on North Asia AI trade ideas in June.

Nevertheless, an executable idea into or post their interim earnings scheduled to report end of August, and perhaps one to accumulate on continued share price weakness. The Company’s net income is expected to swing into profit in Q223. We think Shenzhen airport should be able to track or even deliver above its revenue and net income guidance for H123 is expected to come between CNY 1.925-1.965 billion and loss of (CNY 110-130 million). In addition, in the longer-term Shenzhen airport will also be a big beneficiary of ongoing Greater Bay Area development.

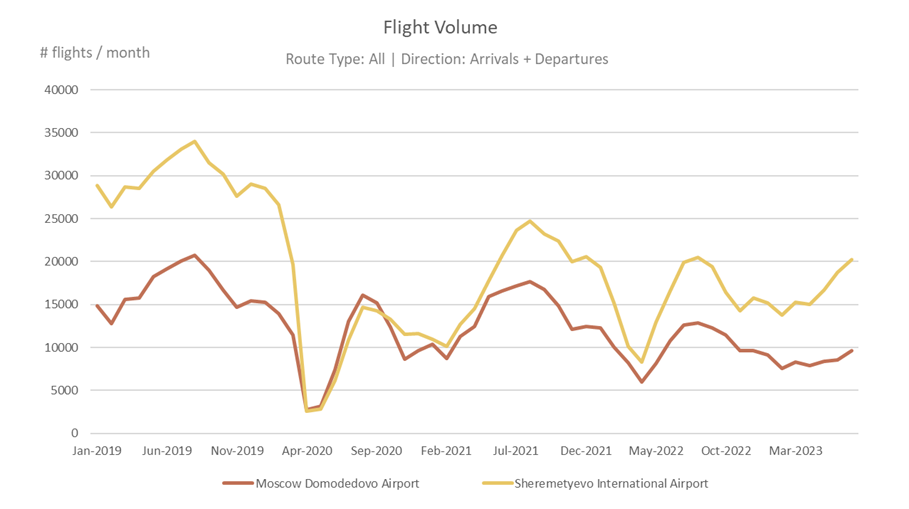

Signs of resilience in Russian aviation despite challenging operating environment

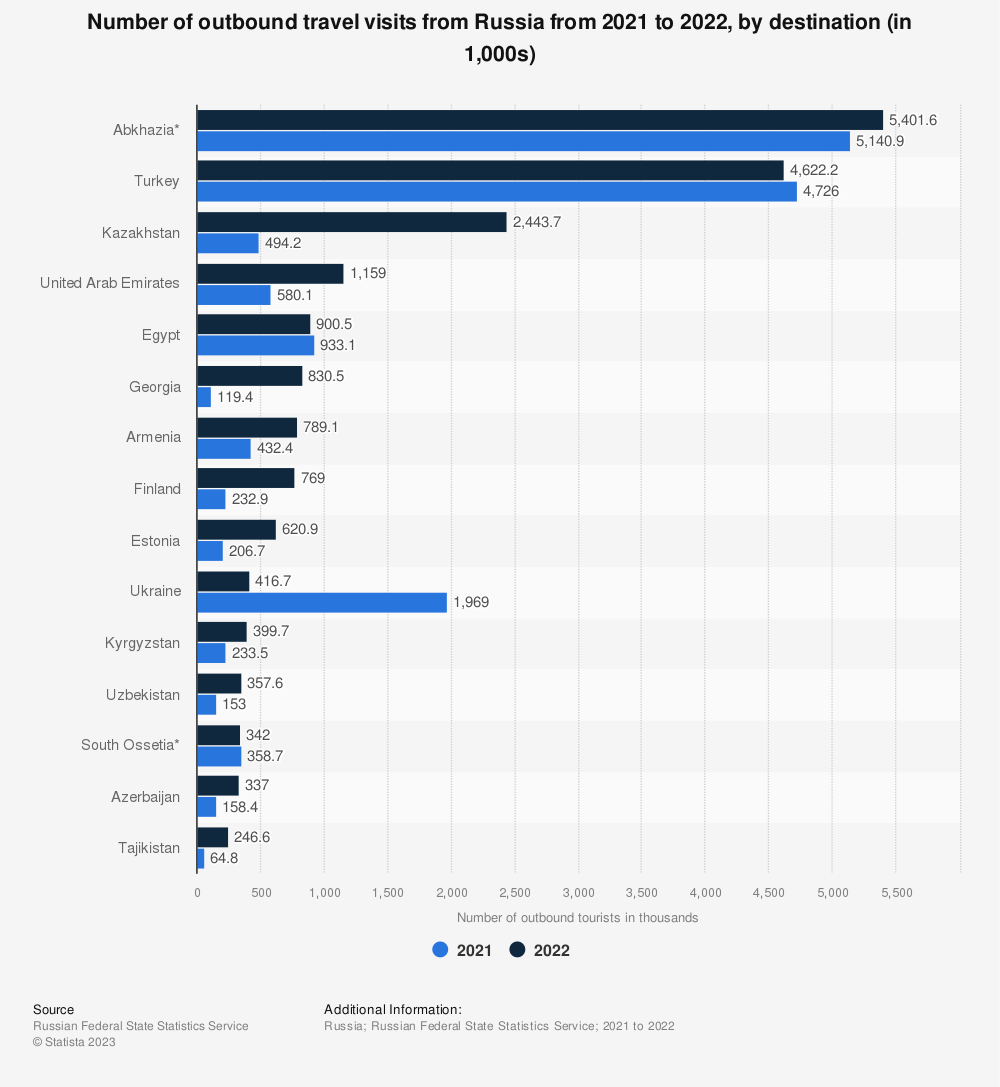

Interestingly, flights out of Moscow have returned to pre-war levels. Russia’s aviation market was already somewhat insulated from the pandemic due to robust domestic travel demand and generally more lax international travel restrictions. In light of the total cessation of traffic between Russia and the EU / US, the rebound in international traffic is mainly driven by Russians opting for friendlier destinations using carriers such as Turkish Airlines (THYAO.IS) and the Gulf carriers. Countries such as Turkey, Thailand, Egypt, the UAE, and the former CIS states, where wealthy Russians are also clamoring to buy real estate, are cashing in on this trend. Russians traveling to and from Europe most often go to Finland or Estonia, from where busses to St. Petersburg are still available.

However, this is not to say that all is fine and dandy in Russia’s aviation market. According to Reuters, a key challenge faced by Russian carriers are sanctions on spare parts for aircraft, forcing them to cannibalize some of their aircraft to keep others. Securing these parts from third party intermediaries in China or the Middle East is expensive and difficult, as these entities risk secondary sanctions due to the detailed paper trail for each of these sophisticated parts. 80% of Aeroflot’s (AFLT.MM) fleet consists of Airbus and Boeing aircraft. Even Russia’s domestically produced Sukhoi Superjet relies heavily on foreign parts.

The troubles faced by Russia’s carriers were not a concern as I took Hainan Airlines from Beijing to Moscow, which was about an 8.5-hour journey. For a company that is amidst a structural reset, heavily indebted and loss making, I was pleasantly surprised to find the flight crew were professional, inflight entertainment was up to date, and the food was better than most European airlines that I have taken in the past. My flight was 85% full, comprising of roughly 75% Russians, Belarusians, or CIS citizens, and 25% Chinese (mix of tourists, students, and businessmen). Financially, the airline is still struggling to reduce its massive losses. However, on the positive side, Hainan Airlines did manage to generate CNY 13.1 billion in revenues in Q123, +106% yoy growth and book a small positive gross profit of CNY 537.3 million (4.1% GPM) for the first time since 2019. This may be a further signpost of a generalized domestic aviation recovery, although Hainan Airlines’ own situation remains precarious.

Chinese aviation cleared for takeoff?

The trip from Hong Kong to Moscow planted the seeds for a more detailed look into aviation, and throughout my trip I continued to relate what I was seeing on the ground to the wider economy and equities in Russia. These pieces will follow in quick succession, and we hope you stay tuned.

In the current environment, China sentiment has turned increasingly bearish, but it’s not all doom and gloom…there are pockets of growth (albeit from a low base) where pandemic policies destroyed valuations. Chinese airlines, airports, and the wider aviation sector are good plays in this thematic despite the turbulent skies ahead. Beijing Airport looks interesting and will be a timing play, but I think the earlier turnaround is Shenzhen Airport as domestic travel and passenger throughput made up a greater proportion of revenue even pre-pandemic. Shenzhen Airport is trading below its pre-COVID 5-year average forward EV/EBITDA and P/E of 11x and 25x, respectively.

Currently, we neither hold shares of Beijing (Capital) International Airport (0694.HK) nor Shenzhen International Airport (000089.SZ) but will look to establish a small trading position in the latter this month, and former at a more opportune time.

Disclaimer: This research piece above is for informational, entertainment, educational, and/or study or research purposes only. The information contained herein or discussed does not, should not, and cannot be construed as or relied upon and, for all intents and purposes, does not constitute or provide professional financial, investment, or any other form of advice. This research does not and should not be construed as an offer to sell or the solicitation of an offer to buy any securities or any other financial instruments in any jurisdiction, including where such actions are illegal. This research is not intended for publication in jurisdictions where it would violate laws. The research does not consider individual investment objectives or financial positions and merely expresses the opinions of its authors. Any investment involves taking substantial risks, including (but not limited to) the complete loss of capital. Every investor has different strategies, risk tolerances, and time frames. You are advised to perform your own independent checks, research, or study, and you should consult a licensed professional before making any investment decisions. The assumptions and parameters discussed or used are not the only reasonable ones, and no guarantee is given for their accuracy, completeness, or reasonableness. No promise is made that any indicative performance return will be achieved. The research is derived from public information sourced by Pyramids and Pagodas. No representation or warranty is given for the reliability, completeness, timeliness, accuracy, or fitness of this research, nor is any responsibility or liability accepted for any loss or damage. The authors (Pyramids and Pagodas) shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.