Why I travelled to Georgia during the anti-government protests of May 2024

Taking a look back at a trip during a tumultuous time, the country’s investment horizons, and some interesting stocks along the way

In May 2024, Desertfox spent two weeks in Tbilisi, the capital of Georgia as well as surrounding rural areas.

Insights and nuance from my two weeks of travel

I had always wanted to explore Georgia, a country with stunning landscapes, delicious cuisine and a promising future. As one of the oldest civilizations in the world, the people are keenly aware of their rich history and are proud of their identity – so all in all quite a cohesive society.

As tends to be the case with many trips involving me and Altraman, we have a knack for coinciding with adverse geopolitical events, so I was unsurprised when anti-Russian protests broke out in Tbilisi weeks before I was set to fly. While this might have deterred many, it was hardly our first rodeo having lived in the Middle East during the Arab Spring. I have a fairly well-tuned sense of what is hysterical Western media reporting and what is a genuine cause for concern (can often be boiled down to – “does the opposition have guns and deep pockets backing them?”).

The Tbilisi protests were portrayed as a situation in which the government was facing broad opposition and a legitimacy crisis that could lead to its ouster – this was simply not the case as we will explain in more detail later. In fact, my two weeks there during this historical time provided a fascinating ground view of one of the many frontlines in the broader battle for influence between Russia and the West. Travelling with a Russian speaker also meant that I could derive more insights and nuance from my conversations there, as much of the older population is proficient in the language.

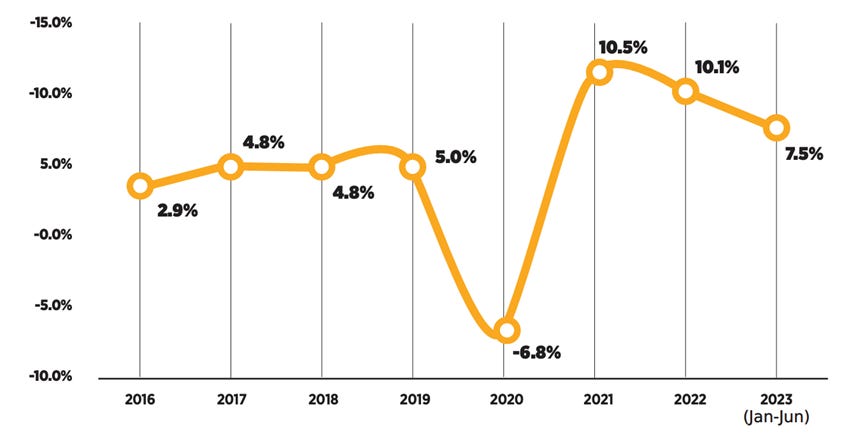

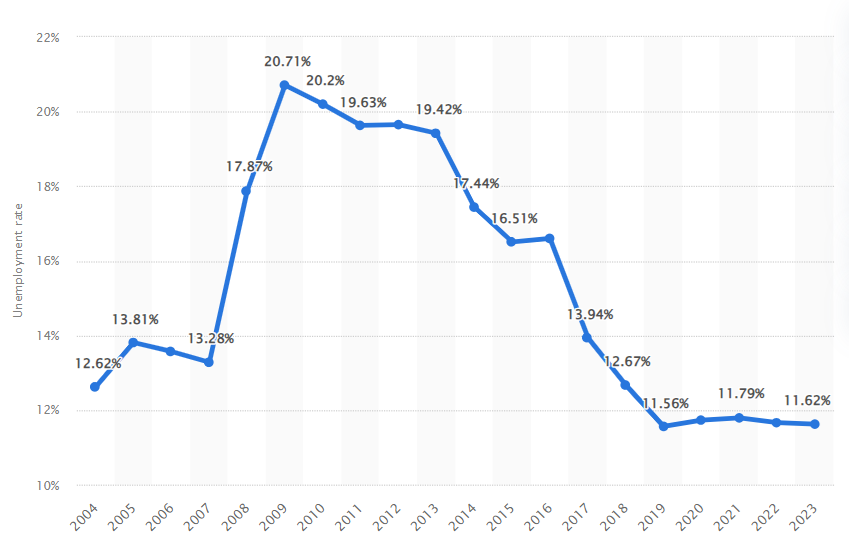

I was also keen to travel to Georgia as I believed it showed economic promise, more than all the negative press would have one believe. Its economy has shown resilience and growth over the past decade, with a GDP per capita increase from USD 9,580 in 2010 to USD 15,880 in 2022. The country has made significant strides in income growth and poverty reduction. The poverty rate has declined from 70.6% in 2010 to an estimated 47.7% in 2022, reflecting fairly sound macroeconomic management. Unemployment rates have also improved, dropping to a record low of 11.6% in 2023.

However, challenges remain, such as weak productivity and limited creation of high-quality jobs. A third of the workforce is still engaged in low-productivity agriculture, and there is a notable skills mismatch in the job market. Georgia's economy is highly open to trade and reliant on tourism, making it susceptible to external shocks. I noticed this openness with the ease of entry into the country. For example, UK citizens get an entire year visa free.

Uncovering the nuanced realities behind the Georgia protests

For those less familiar with the situation in Georgia, some background is needed. In a significant development, Georgia was granted candidate status by the European Union (EU) in December 2023, which was expected to drive reforms and economic convergence with EU member states.

In 2024, Georgia experienced significant anti-Russian protests in response to a controversial law perceived as aligning with Russian-style legislation. This law, aimed at curbing “foreign influence”, was met with widespread opposition, as it threatened the country's aspirations for EU membership and was seen as a step back from democratic principles. In reality, the law simply stipulated that local NGOs divulge foreign sources of funding. Yes…the same type of NGOs that the US has conveniently used as vehicles for regime change in other parts of the world suddenly in need of “democratic awakening”.

Similar laws exist in the countries that were so vehemently opposed to this new Georgian law, for example the US Foreign Agents Registration Act. This raises questions about double-standards and selective criticism. Certainly, there were legitimate concerns expressed about the potential for democratic backsliding and abuse of the new Georgian law by the ruling pro-Russia Georgian Dream party, which has faced its own controversies. However, it is an oversimplification to characterize this as a wholesale collapse of democracy in the country. It was also not surprising to see that Western countries had a bone to pick with Georgian Dream for not taking a more hardline stance against Russia post Ukraine invasion.

Despite Georgian Dream being pro-EU membership and fostering rapid economic growth and Western-style development, it aims to avoid provoking Russia. They believe that a hostile stance towards Russia benefits only their EU/US partners, not Georgia itself. The US has a well-documented history of funding and training opposition groups of regimes it doesn’t like, often portraying rebel groups positively and condemning government actions.

As pointed out by fellow fintwit commentator Lyall Taylor (LT3000Lyall), a strangely high number of NGOs operate in this small country (25,000 in fact). Some of these, armed with western funding, spread anti-government rhetoric and influence local and global media. Across the world, these groups cultivate grievances and organize protests, aiming to provoke government reactions that can be used to depict the government as oppressive. While grassroots participation is crucial for a revolution, it doesn’t require a majority; a small, passionate minority can be enough. In Georgia, around 30,000 protestors, less than 1% of the population, were involved, many influenced by anti-government NGOs.

Economically, while Georgia faced an economic slowdown, it did enter a recession by the time protests concluded in June with the passing of the law. The country's economic forecast suggested a resilience attributed to recent development successes and strong demographics, despite the political turmoil. The labor market remained robust, and household finances were stable, which supported continued economic expansion.

How Russia came to be such a hot topic in Georgia – for some more than others

The Russian presence in Georgia has been a significant factor in the country's economic development, particularly since the outbreak of the Russia-Ukraine war. Many wealthier Russians have moved to Tbilisi to dodge the draft or escape a stifling political climate, and this is well-reflected in the property prices and language overheard at cafes in the pricier locales of the capital. It seemed that younger, more liberal-minded Georgians were all-too-willing to speak out against Russian influence, yet the landlord and business owner class were happy to cash in on the influx.

The real estate market in Georgia has experienced significant growth, with house prices soaring by 12.78% in 2023, following substantial increases in previous years. This surge is attributed to strong economic growth and falling interest rates, alongside robust property demand. The influx of Russian investment has been a notable factor, especially in the wake of geopolitical events that led to a marked increase in Russian nationals purchasing property in Georgia. The capital, Tbilisi, has seen varied price movements across different districts, with some areas witnessing price hikes up to 35.8% yoy.

Despite the protests, there did not appear to be any overt hostility against the many Russian emigrees, with most protestors seeming to understand the differences between Russian government policy and the personal lives of those who chose to de-camp to Georgia. This was laid bare as anti-Russian slogans emanated from downtown as I sat alongside Russian digital nomads tapping away on their laptops in pricey cafes just streets away from the commotion.

Perspectives on Russia can vary significantly between generations and regions. In my time there, it became quite apparent that anti-Russian sentiment was concentrated in a younger, more educated and urban demographic. Older generations, who may have more vivid memories of the Soviet era, might hold different views that are shaped by Georgia’s once-privileged position in the USSR. For example, in the Soviet era, Georgia had the highest education, savings, car and home ownership levels in the Union.

I was struck by older Georgians who mostly expressed disapproving views of the protests. This became more pronounced when leaving the capital – those in rural areas were nothing but welcoming to my Russian friend. In one region we travelled to, Kazbegi, local people were notably reliant on goods and fuel from Russia, often hopping across the border to stock up on much cheaper commodities.

China’s footprint in Georgia’s infrastructure evolution

Speaking of foreign influence, I also sensed China’s presence in a big way. A free trade agreement and slew of Belt and Road infrastructure investments such as the Anaklia deep seaport and the Rikoti pass have spurred close economic ties. The Rikoti Pass is a massive undertaking featuring dozens of bridges and tunnels, representing USD 1 billion in investment. There were many PRC nationals residing long term in Tbilisi, as well as businesses catering to them.

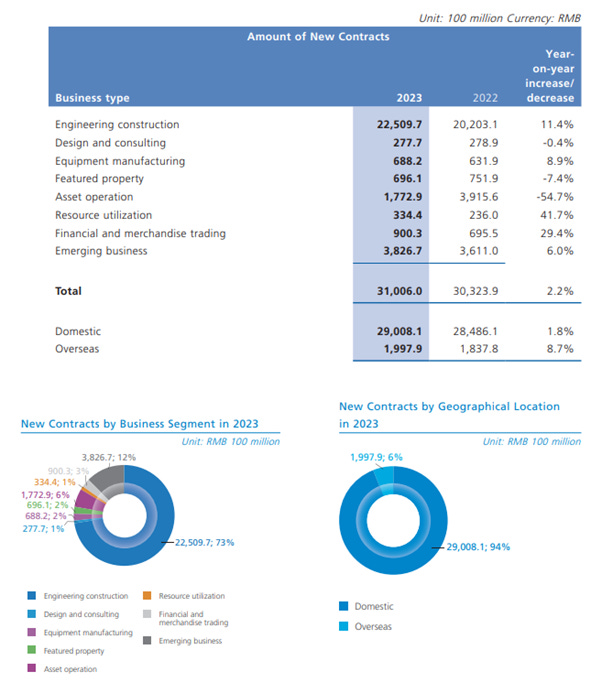

It was surprising to see China Railway Group (0390.HK; 601390.SH) billboards around a massive highway project in a remote mountain pass. Turns out the currently congested two lane road is one of the main arteries into Russia, with this mountain pass a particular bottleneck. The USD 558 million project is funded by the Asian Development Bank and European Bank for Reconstruction and Development, both western-leaning institutions and yet a Chinese contractor was selected, presumably for their local knowledge and speed of implementation.

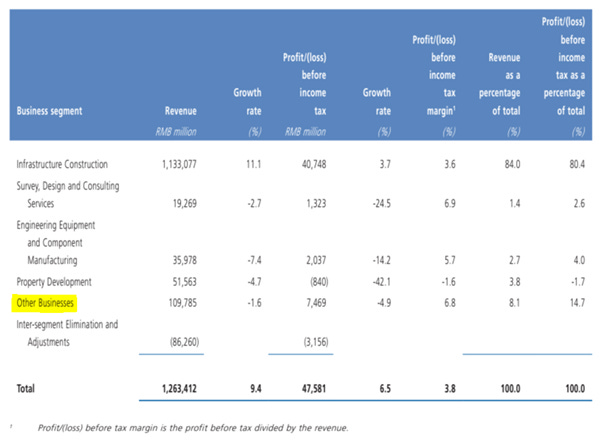

This SOE stock looks cheap, trading at a blended 12-month forward P/E of 2.5x, about 1 standard deviation below its five-year historical averages, with a dividend yield of 6.7% at the current price (HKD 3.62 as of 30 August 2024). Most of its revenues come from its stable domestic “Engineering construction” segment, involving major contracts in railways, energy, and water infrastructure. Its offshore business is surprisingly only 6% of Group revenues; one would expect a larger portion in emerging markets given media headlines of new projects announced yearly. The overall net margin is 3%, which makes sense given the high upfront investment and long ramp-up periods, but also very long useful lives. There are unlikely to be significant surprises in the Group’s mid-to-high single-digit revenue growth rate, supported by domestic infrastructure spending forecasted to align or exceed the ~4.4% GDP growth this year. The stock performance since its listing in 2007 has been a sulky -51%. This year, it seems we have hit the bottom (HKD 3.16 on 23 January 2024). There were slight EPS downgrades in Q124A and FY24e guidance, leading to near-term share price weakness.

However, we do like the fact that its fundamentals rank ahead of other SOE construction peers such as CRCC (1186.HK, 601186.SH) and CCCC (1800.HK, 601800.SH) in cashflow, profitability and ROE. In addition, interestingly, China Railway Group has stowed away a resources business under “Other business” segment. They have 5 operational mines delivering copper, cobalt and molybdenum, contributing only 0.7% of Group revenues, but generates 14% of the Group’s profit contribution and growing. This is somewhat similar to TCL Electronics (1070.HK) trade setup we covered earlier in the year, where revenue growth and profitability in its auxiliary businesses supersede its core bulk of the business, and among the catalysts sparking a re-rating (though realization may take longer for the case here).

We see potential for improvement in China Railway Group, though not to the same extent as TCL. The market hasn’t fully priced in better fundamentals, operational efficiencies, and growth in the resources business. This could be a good entry point after resetting expectations, but our conviction is low due to limited visibility. We’ve taken a small trading position with a target range of HKD 4.50–5.25 (top-end implies 3.5x P/E, around the historical 5-year average).

The digital shift – Payment technologies on the rise

Another thing that struck me was the proliferation of electronic payment availability. Cards were accepted at almost all sit down restaurants and small convenience stores, with mostly Verifone and Pax Global (0327.HK) terminals in use. As covered in our investment brief on Pax back in November 2022, the CIS market only makes up a small portion of the Group’s revenue, but no doubt many terminals imported into Georgia, most likely end up in Russia as highlighted in Altraman’s Russia insights in September 2023. The fintech landscape in Georgia is experiencing a significant transformation with the proliferation of payment machines like 1pay, TBC Pay, and Cryptal, which I encountered more frequently than ATMs on the streets of Tbilisi. 1pay and TBC Pay are mostly used for e-commerce, bills, and transfers whereas Cryptal machines are used for buying and selling cryptocurrency.

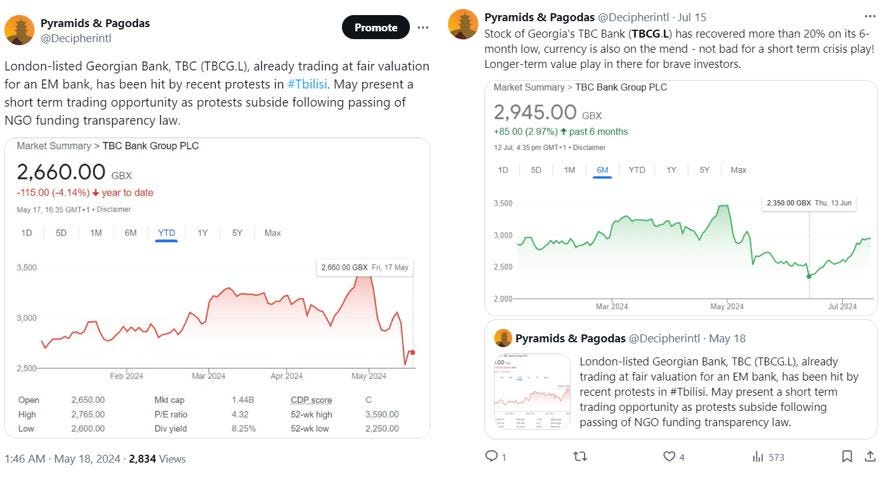

This digital shift is not just modernizing the transactional framework of the country but also unveiling new investment opportunities within the fintech sector. We took a deeper look into TBC Bank (TBCG.L), the operator of TBC Pay machines, given that its London-listed stock took a beating during the protests, and was down around 30% from ATH earlier in the year.

Banking on Georgia – the case for TBC Bank

TBC Bank stock has shown resilience and adaptability in a dynamic market environment. Its fundamentals were strong and offered robust dividend yield of over 7%. Unlike the picture portrayed in Western media, the reality on the ground told us that the protests, in fact, did not have broad support and we believed they would be short-lived. Furthermore, Georgia did not bear the hallmarks of dysfunctional institutions and a government teetering on the edge of collapse. The state does not face fundamental issues with its legitimacy, and has sufficient resources to quell disorganized protests – obviously heavy-handed police tactics are not to be condoned, but we were just being realistic about the situation.

Hence we bought the stock, which has now recovered to near its ATH level, netting us a nice 20% short-term gain (it could have been even more, but impossible to time the bottom in these situations.) There is of course room for the stock to run further, but think there are cheaper emerging market fintech/banking alternatives. A cheaper peer that we’ve seen floating around the fintwit sphere is Kazakhstan’s Halyk Bank (HSBK.L) although we haven’t done any work around it.

Be sure to follow our account on X (Twitter), as we occasionally do post some short-term tactical or interesting ideas and musings that don't make it as part of a longer post given general timing of events etc.

Full disclosure: Currently, both me @TheAltraman and @Desertfox have an established position in China Railway Group. We still hold Pax Global, and have sold TBC Bank.

Disclaimer: This research piece above is for informational, entertainment, educational, and/or study or research purposes only. The information contained herein or discussed does not, should not, and cannot be construed as or relied upon and, for all intents and purposes, does not constitute or provide professional financial, investment, or any other form of advice. This research does not and should not be construed as an offer to sell or the solicitation of an offer to buy any securities or any other financial instruments in any jurisdiction, including where such actions are illegal. This research is not intended for publication in jurisdictions where it would violate laws. The research does not consider individual investment objectives or financial positions and merely expresses the opinions of its authors. Any investment involves taking substantial risks, including (but not limited to) the complete loss of capital. Every investor has different strategies, risk tolerances, and time frames. You are advised to perform your own independent checks, research, or study, and you should consult a licensed professional before making any investment decisions. The assumptions and parameters discussed or used are not the only reasonable ones, and no guarantee is given for their accuracy, completeness, or reasonableness. No promise is made that any indicative performance return will be achieved. The research is derived from public information sourced by Pyramids and Pagodas. No representation or warranty is given for the reliability, completeness, timeliness, accuracy, or fitness of this research, nor is any responsibility or liability accepted for any loss or damage. The authors (Pyramids and Pagodas) shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Georgia capital Group is an interesting Georgian focused serial acquirer. I think they also allow you to own Bank of Georgia at a discount

Interesting. I just went to Georgia and just wrote an account on my personal newsletter China Translated. I can confirm many of the points you have observed here.