Rusal (RUAL.MM; 0486.HK) – Aluminium giant steels itself against challenging conditions

Navigating short-term headwinds and leveraging greener production for future opportunities

Altraman’s Russia trip (links aggregated below) uncovered some ground truths about the resilience of local companies there and identified both direct and proxy-play opportunities available via listed Chinese companies with the aim of capitalizing on the warming ties between the two countries.

Part 1: Notes on the current state of air travel in Russia and China on my journey to Moscow

Part 2: Chinese manufacturers stepping in to get Muscovites from A to B amid sanctions

Part 3: Major western retailers and fast-food chains head for the exits while local brands step in

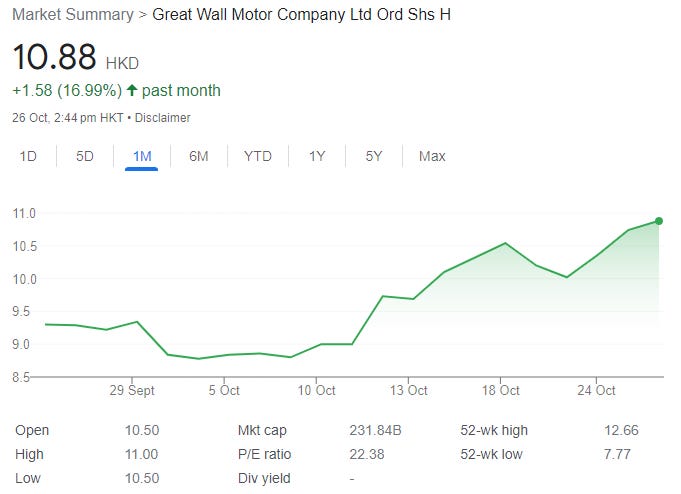

Most prominently Great Wall Motor (2333.HK; 601633.SS) stood out to us as a major beneficiary from the exodus of Western automakers from Russia - a trading position that is serving us well (stock up 17% to date from our coverage and entry last month).

Amidst the suspension and delisting of Russian companies from Western exchanges, we thought it might be interesting to investigate Russian companies listed in Asian markets. One such example is United Company RUSAL International PJS (RUAL.MM; 0486.HK) ("Rusal"), with whom we met at their Hong Kong office this month.

Third largest aluminium producer with cost advantages and diversification through investments

Rusal (market cap – USD 5.5 billion), dual listed on the Moscow (MOEX) and Hong Kong (HKEX) stock exchanges, is the world’s third largest aluminium producer. In the early 90s, the Russian aluminium industry faced severe challenges due to hyperinflation, budget cuts, and the disappearance of captive markets that made up the USSR and its allies. State-owned smelters and refineries were paralyzed and cut off from their raw material suppliers. With the implementation of economic reforms and privatization of state enterprises, Oleg Deripaska (OFAC sanctioned), a former trader and CEO of state-owned Sayanogorsk Aluminium Smelter (SAZ), took the initiative to privatize SAZ and use its profits to build an aluminium foil mill. He then formed Sibirsky Aluminium (Sibal), bringing together his various metals businesses and made further acquisitions. In 2000, Deripaska's Siberian Aluminium and Roman Abramovich's Millhouse Capital merged their assets, leading to the establishment of RUSAL, one of the world's largest aluminium producers. This merger brought together struggling state-owned smelters and refineries with private investment, creating a new powerhouse in the global aluminium industry.