We would like to wish all our readers happy holidays and say a big thank you for your ongoing support. In comes the New Year, a time for reflection on the past and future. We are all on a learning journey, and for us with each article or podcast episode, we gain more insight into how we can better serve our audience amidst the sea of great content out there. We decided to start Pyramids and Pagodas to build upon and share our interests, but also capture underreported macroeconomic and political events and explain their implications on the world at large. Our aim to highlight this dovetails well with our passion for investing and we have decided to drill down into this in the coming year by delivering our macro and geopolitical coverage with some clear takeaways on market trends and signals.

The response to our sector or stock specific has been encouraging. Into the new year, we will look at doing in-depth discussions on our geographies and sectors of interest and uncovering some more investable opportunities in emerging markets. We invest in our own ideas, rather than offering armchair commentary without having skin in the game. By the end of 2023, we hope to have built a healthy portfolio and track record in identifying value propositions and reading macro trends.

Below is our a round-up featuring some interesting developments on the global geopolitical scene. Moving forward, we will continue to flag things that catch our attention, but more on an ad-hoc basis in attempt to spend more time exploring different sectors and businesses in our focus areas.

Saudi Arabia accepts “the Chinese Bid”; Xi and partners paving the de-dollarization path

Our first blog post of early 2022 highlighted the push for trade de-dollarization by Beijing, Moscow, and certain wealthy Gulf states. This trend accelerated over the course of 2022 (albeit from a slow pace). Due to Sino-US tensions, the Russia-Ukraine conflict, and various other factors, we don’t see any reason for a slowdown – although we maintain there is no short-term threat to dollar hegemony. As we discuss later, gold as a neutral asset will benefit in the longer term due to an increasingly fractured global environment and the need to anchor (potentially new) reserve currencies. Several states have shown growing interest in moving away from dollar hegemony and the leverage this gives Washington and its allies.

As we pointed out in March 2022, this trend is partially driven by a growing concern in certain countries that the US and its allies are weaponizing control over reserve currencies to punish those that fall foul of western foreign policy objectives. This has played out in various forms such as sanctions, blocked access to financial systems, and asset seizures. We noted:

The unintended consequence is an effective announcement to the world that FX reserves abroad are not safe and subject to seizures or freezes by the US and EU. We think weaponization of money at this scale can only be deployed once; countries looking at this will be contextualizing USD hegemony when dealing with their own internal affairs.

Quote from Pyramids and Pagodas: Impact of Sanctions on Russia Fades Amid Shifting Sands of New World Order?

This story is not just confined to China, Russia, and Middle Eastern states. In June 2022, we covered a story on UltraTech Cement (ULTC.NS), India’s biggest cement producer paying for Russian coal in Yuan.

Riyadh’s growing frustrations with dollar hegemony and China’s bargaining power

In April 2022, we reported that Saudi Arabia was in talks to price oil exports in Yuan instead of USD, and

While these talks have been active for the past six years, we believe the mood in Saudi Arabia has shifted since beginning of the Russian-Ukraine conflict.

Quote from Pyramids and Pagodas (Saudi Arabia in Talks to Price Oil Exports to China in Yuan Instead of USD)

Talk is cheap, but with the deteriorating 80-year-old Saudi-US relationship, particularly under the Biden administration, as well as China being the biggest importer of Saudi crude, interest in Riyadh and Beijing appears to have heightened. Reuters reported on 9 December 2022 during President Xi’s visit of the Kingdom that

China will continue to import large quantities of crude oil from GCC countries, expand imports of liquefied natural gas, strengthen cooperation in upstream oil and gas development, engineering services, storage, transportation and refining, and make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade,

Reuters (9 Dec 2022) - China to use Shanghai exchange for yuan energy deals with Gulf nations - Xi

This trend isn’t isolated to Saudi Arabia. We have also noted in several pieces China’s increasing footprint in Iraq’s O&G sector, hopefully one to be covered in greater depth in the new year (Iraq was the top recipient of BRI investments in 2021) and would not be surprised to see similar Yuan-denominated trade in Iraq, as we have already seen in other key regional partners such as Egypt and the UAE. Similarly, we covered China’s increasing role in Egypt’s macroeconomic landscape, as well as specifically in the renewable energy sector in recent pieces.

Chinese investments in Saudi Arabia and Vision 2030

Along with that, Saudi state media announced the signing of USD 50 billion worth of investment agreements in sectors including construction, IT, logistics and renewables, and these aren’t the only areas of cooperation. These bilateral developments continue to play well into the Saudi Vision 2030 on diversifying its economy and developing public sector services. There are plenty of alternative benefits for them holding CNY as discussed earlier in April.

Saudi Arabia’s tilt towards China also plays well into the Saudi Vision 2030, which is a strategic framework erected by the Saudi government to reduce the Kingdom's dependence on oil, diversify its economy, and develop public service sectors. The PIF [Saudi sovereign wealth fund] has ambitions to control USD 2 trillion of assets, but most of its public investments have been in the US and EU. The ability to draw on foreign investments including Chinese bonds and equities to realize its vision would be a net benefit to the Saudis”

Quote from Pyramids and Pagodas (Saudi Arabia in Talks to Price Oil Exports to China in Yuan Instead of USD)

We have covered the activities of several Chinese tech companies in Saudi Arabia, such as Huawei and Alibaba. These deals are attractive to the Saudis as they come at a discount to western peers and have less issues around technology transfers and surveillance applications of their technologies. For Beijing (which provides cheap credit and diplomatic support), these deals be depicted as “successes” of the BRI, at the same time that these companies are facing an increasingly challenging operating environment in western markets. In our deep dive pieces, we have also noted that companies like PAX and Didi are increasingly focusing on emerging markets due to political and economic pressures at home, as well as the threat posed by Sino-US tensions.

Deepening of Sino-Saudi ties and China’s growing clout among Middle Eastern states

Interestingly, President Xi’s first trip since the outbreak of COVID-19 was to the Shanghai Cooperation Organization ("SCO”) meeting held in Samarkand, Uzbekistan, which we covered in-detail in our September round-up. That event marked another opportunity to shore up friendly currencies; nine member states, which represent 40% of the global population, agreed to increase trade through local currencies. However, implementation at scale remains to be seen. Since then, Iran has formally acted to attain SCO full membership, while other regional states such as Saudi Arabia, Qatar, and Egypt have become dialogue partners. We note that Qatar has significantly progressed in its gas sales to China since we last covered that country, despite the hype about China switching to Russian imports – at the end of the day, pipeline capacity is limited and Qatar remains a stable and reliable source of the commodity.

The deepening of geopolitical ties between China and Saudi Arabia reminded us of a scene from one of our all-time favorite movies, Syriana (2005), which is loosely based on Robert Baer's 2003 memoir See No Evil (great book too). Even back then, Hollywood was already portraying (albeit fictionally) the growing rivalry between the US and China for Middle Eastern oil reserves. In the scene, a Gulf royal asserts his interest in shifting away from a reliance on the US and taking the country down a different path with China, i.e. selling oil for economic development instead of wasting billions of dollars on western weaponry and (luxury) toys.

Bryan Woodman (Matt Damon): [In claiming that western oil firms and the global financial system are predatory in their dealings with oil producers] They’re thinking, keep playing! Keep buying yourself new toys! Keep spending $50,000 a night on your hotel room! But don’t invest in your infrastructure! Don’t build a real economy! So that when you finally wake up, they will have sucked you dry, and you will have squandered the greatest natural resource in history.

Prince Nasir Al-Subaai (Alexander Siddig): […] I want to create a parliament. I want to give women the right to vote. I want an independent judiciary. I want to start a petroleum exchange in the Middle East. Cut the speculators out of the business. Why are the major oil exchanges in London and New York anyway? I’ll put all of our energy up for competitive bidding. I’ll run pipe through Iran to Europe like you proposed. I’ll ship to China. Anything that achieves efficiency and maximizes profit…Profit which I will then use to re-build my country.

Bryan Woodman (Matt Damon): Great, that’s exactly what you should do.

Prince Nasir Al-Subaai (Alexander Siddig): Exactly…except your president rings my father and says I’ve got unemployment in Texas, Kansas, Washington State…One phone call later, we’re stealing out of our social programs in order to buy overpriced airplanes…We owed the Americans, but we’ve re-paid that debt.

Dialog excerpt from Syriana (2005) clip

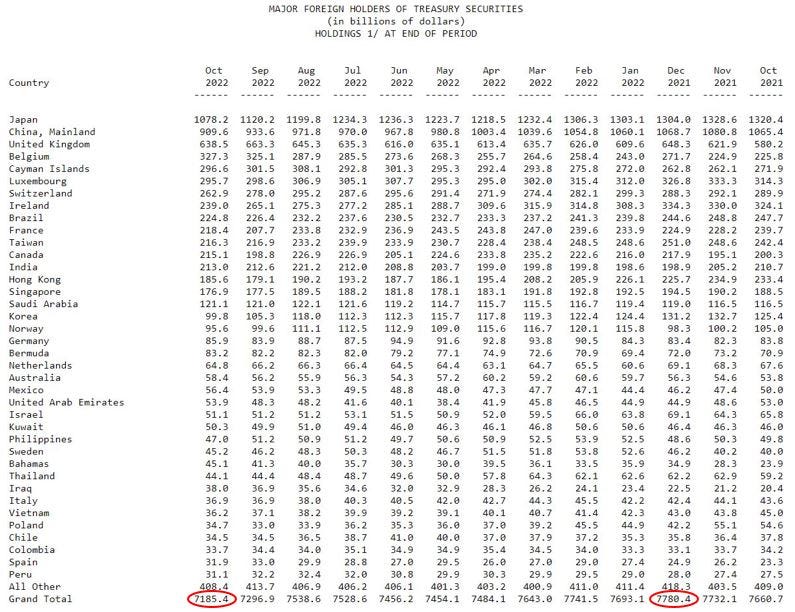

A pre-existing shift away from the petrodollar

It seems Riyadh along with other key regional producers such as Iraq and Iran have already accepted the “Chinese bid,” and China has long since become their largest oil import client. The US has been assisted by the Kingdom in stabilizing the dollar over the past 50 years after President Nixon withdrew dollar from the gold standard in 1971 (Nixon shock). A dollar seigniorage (petrodollar) was developed through Saudi oil profits – the US purchased large amounts of USD-denominated oil, which the Saudis in turn would use to buy a significant amount of US Treasury securities, other US financial assets and weaponry. We did report in early February 2022 that the Kingdom had sold a significant amount of US Treasuries (“USTs”) since early 2020. The Saudis since have not been keen to re-purchase a greater portion of USTs as seen from the table below.

The Yuan’s relevance as a global currency

Many western analysts quick to point out the lack of threat the Yuan poses to the dollar given many Middle Eastern currencies are dollar-pegged, the Yuan lacks liquidity and convertibility, and its worldwide footprint (representing 3% and 2% of global foreign currency reserves and payments respectively) is miniscule.

Well, they aren’t wrong in that respect….but we may be witnessing a long-term shift towards a multi-currency global energy market. The oil market as the insurance policy to the dollar status as global reserve currency is being chipped away at, even if slowly. We aren’t arguing for the Yuan’s displacement of the dollar as the global premier currency in the near-term. In any case, we think an outcome of that magnitude would take at least a decade or two to materialize before witnessing any serious challenge towards the US monetary privilege.

What this could mean for gold going forward

Saudi Arabia and China can start to utilize the gold exchanges in Shanghai and Hong Kong. The existence of Yuan-backed oil and gold futures will open a window for physical gold settlement. It is worth mentioning that this idea of launching a gold-backed oil-Yuan futures contract being an industry game-changer has been hyped by rumors and analysis within the blogsphere, as well as prominent economists like Zoltan Pozsar since 2017. However today, there are many more reasons to us inching closer to this outcome than before. Settling through gold is a great mechanism for oil producers like Saudi Arabia and Russia when it comes to avoiding USD to become less vulnerable to dollar weaponization.

China and India have been markedly increasing gold reserves over the years, with the former showing strong appetite in 2022 importing 902 tons, in addition to 300 tons mined locally each year. Beijing’s increased gold purchases could relate to an eventual oil-Yuan-gold settlement, which would be one of the many catalysts supporting a longer-term trend of higher gold prices as increased physical gold demand grow meaningful.

It is also interesting to note that global central banks seem to have shifted foreign reserves from USTs to gold since start of the Russian-Ukraine conflict. The year-to-date selling of USTs through to October 2022 amounted to USD 595 billion, compared to gold which saw 673 tons in purchases, bringing official gold reserves to its highest level since November 1974 (36,782 tons).

We have discussed earlier in the year for owning gold and gold miners (neutral asset), but -0.2% total return over the year has not given us much to cheer about. That said, its performance relative to equities and bonds has been stellar with up to +10% gain in Q422, which should bode well for 2023.

In any case, we like the structural bull case for this asset class from a geopolitical perspective and are sure there is plenty of gold-bulls and supporting material that are starting to pick up this trend as we have flagged. We are not seeing any reason for us not to accumulate more in the rest of 2023.

Disclaimer: This research piece above is for informational, entertainment, educational, and/or study or research purposes only. The information contained herein or discussed does not, should not, and cannot be construed as or relied upon and, for all intents and purposes, does not constitute or provide professional financial, investment, or any other form of advice. This research does not and should not be construed as an offer to sell or the solicitation of an offer to buy any securities or any other financial instruments in any jurisdiction, including where such actions are illegal. This research is not intended for publication in jurisdictions where it would violate laws. The research does not consider individual investment objectives or financial positions and merely expresses the opinions of its authors. Any investment involves taking substantial risks, including (but not limited to) the complete loss of capital. Every investor has different strategies, risk tolerances, and time frames. You are advised to perform your own independent checks, research, or study, and you should consult a licensed professional before making any investment decisions. The assumptions and parameters discussed or used are not the only reasonable ones, and no guarantee is given for their accuracy, completeness, or reasonableness. No promise is made that any indicative performance return will be achieved. The research is derived from public information sourced by Pyramids and Pagodas. No representation or warranty is given for the reliability, completeness, timeliness, accuracy, or fitness of this research, nor is any responsibility or liability accepted for any loss or damage. The authors (Pyramids and Pagodas) shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

References:

https://www.reuters.com/business/energy/chinas-xi-tells-gulf-nations-use-shanghai-exchange-yuan-energy-deals-2022-12-09/

https://www.bloomberg.com/news/articles/2022-12-11/saudi-arabia-says-50-billion-investments-agreed-at-china-summit

https://www.aljazeera.com/news/2022/12/8/saudi-crown-prince-meets-chinas-xi-in-push-to-deepen-ties

https://arabic.cnn.com/business/article/2022/10/21/saudi-china-agree-nuclear-energy

https://www.reuters.com/business/energy/chinas-xi-tells-gulf-nations-use-shanghai-exchange-yuan-energy-deals-2022-12-09/

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q3-2022/central-banks

https://www.bloomberg.com/news/articles/2022-11-03/mystery-whales-baffle-gold-market-after-central-bank-purchases

https://www.gold.org/goldhub/gold-focus/2022/12/central-banks-maintain-their-appetite-gold

https://en.wikipedia.org/wiki/List_of_countries_by_proven_oil_reserves

https://thedeepdive.ca/zoltan-pozsar-g7-investors-should-worry-about-gold-backed-renminbi-eclipsing-dollars-commodity-encumbrance/

https://edition.cnn.com/2022/11/21/energy/qatar-china-gas-deal/index.html

https://www.scmp.com/news/china/diplomacy/article/3202067/xi-jinpings-trip-saudi-arabia-another-step-scos-mideast-expansion

https://www.bankfab.com/en-ae/about-fab/group/in-the-media/fab-chinese-yuan-denominated-formosa-bond